Bitcoin (BTC) has already broken the parabolic uptrend that had everyone hoping for a rally to a new yearly high or a new all-time high. The weekly chart for BTC/USD shows that it has now declined below the rising wedge and is hanging by a thread to break below the 38.2% fib extension level from the December, 2018 lows. If the price falls below the 38.2%, we are likely to see a flash crash to the 61.8%. This is when most traders will realize that maybe that is not the beginning of a new bullish cycle. For the past few months, we have been consistently discussing how this is not the beginning of a bullish cycle and how the ongoing market cycle has to be longer than the previous market cycle. This is what has happened the whole time in Bitcoin (BTC) history and there is a reason that happens over and over again.

As more money flows into Bitcoin (BTC), its market cycles get more stretched out. So, if it is going to take a lot longer than before for the bullish part of the cycle to come to fruition, it is also going to take longer for the bearish part of the cycle to come to fruition. If we were to take the December, 2018 lows as the bottom of BTC/USD, then we would be assuming that the recent market cycle had been shorter than the one that preceded it. Historically, that has never been the case which is why we do not think the bear market is over. Once we establish that, it is easier to see what the price is doing and where it could fall to from here. If we look at the weekly chart, the MFI indicator shows that the price has run into resistance and is now on the verge of a sharp decline.

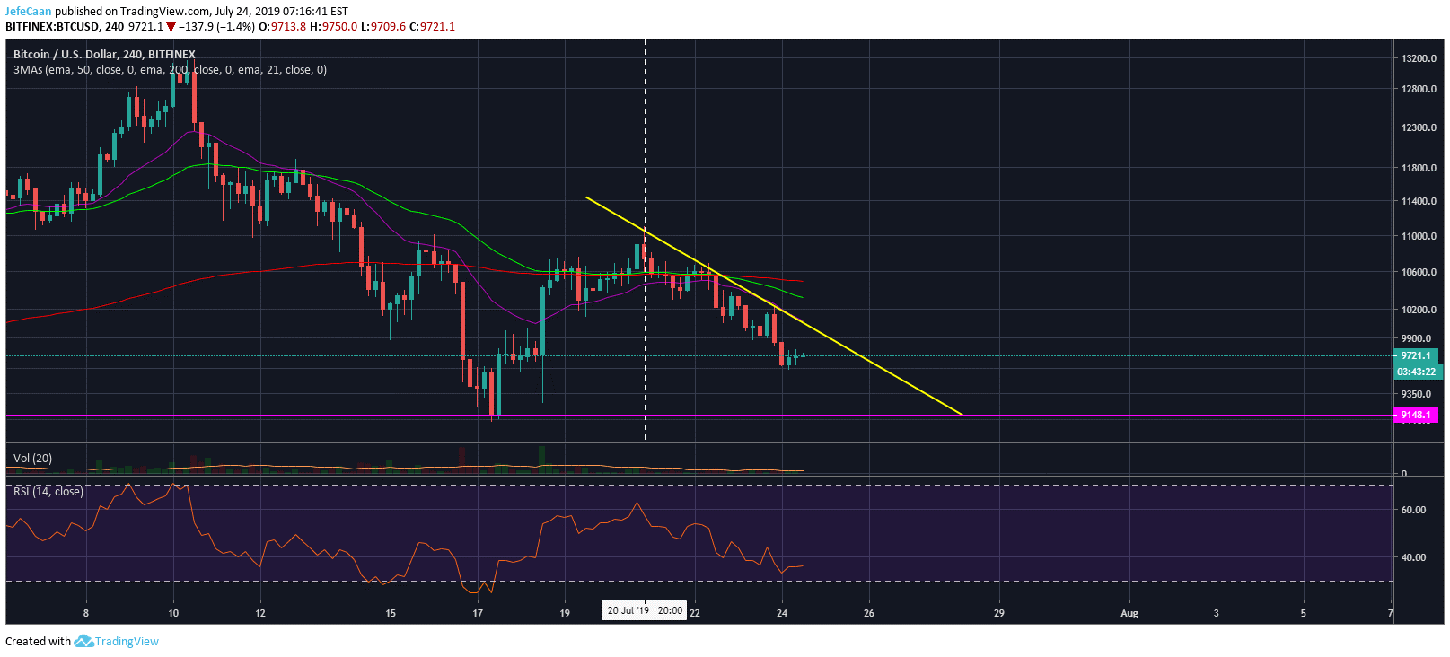

Taking a look at the 4H time frame, we can see that BTC/USD is printing a symmetrical fractal that is likely to see the price fall down to $9,000 in the near future. The price has been stalling this move to the downside but it cannot do this forever. Sooner or later we are going to see this decline. There is trouble brewing in the market and those that are seeing the warning signs have already run for the exits. Most of the people that still expect the price to go up from here are either overly bullish retail traders or ‘crypto hedge fund’ managers.

It is shocking to see that most of these popular crypto activists are still calling for a new all-time high this year when the charts tell us quite the opposite. It is hard to say if they are doing this on purpose or they actually cannot see what is going on, but one thing is clear and that is never to listen to people that have this much skin in the game. It is in their interest to see the prices keep on rising which is why they may continue to mislead their followers but it is important to note that we have been through a long bear market and this has been a major learning experience for most traders. It should now be clear to most people who to listen to and who not to listen to about what is likely to follow next.

Leave A Comment