Bitcoin (BTC) broke below the key ascending channel and has once again declined back inside the descending triangle after a fake move that misled a lot of traders. The RSI on the 1H chart for BTC/USD tells us that there is still a good chance that we might see another move to the upside but the bulls have run out of momentum to do anything consequential here. The most we could see here is another attempt to break out which would just delay the inevitable decline down to the bottom of the descending triangle. I think we could see some bullish relief over the weekend but next week could be devastating for Bitcoin (BTC) and other cryptocurrencies.

The big picture remains intact as we have just seen because these short term moves are mere distractions to divert attention of retail traders from what is really happening. Here’s a useful exercise that might help you a lot. Pull up a BTC/USD chart and remove all line and indicators. Then look at the price action and draw simple horizontal lines and trend lines. You can see how easy and straightforward all of it is. What does this tell us? It tells us that we are baffled by emotions and an influx of information short term but if we stay focused on the big picture and keep it as simple as possible without using a ton of fancy indicators or mathematical models, I think it all makes a lot of sense. Remember, all you need is a good risk management strategy and some foresight to see the next move. You cannot expect to win every trade but like George Soros says, “It is not about whether you are right or wrong, but it is about how much you win when you are right and how much you lose when you are wrong.”

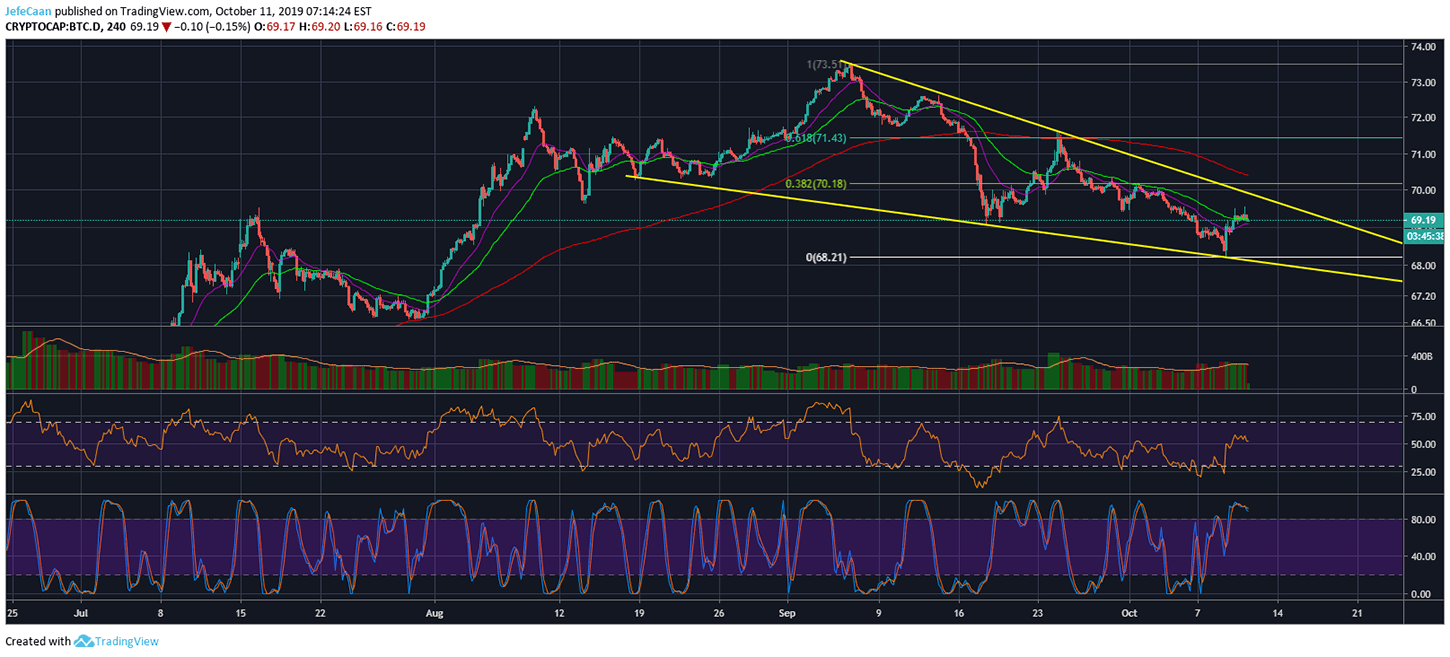

Bitcoin dominance (BTC.D) has always played a key role in the direction of the market. Trends in Bitcoin dominance (BTC.D) indicate what is likely to happen next. The 4H chart for dominance shows us that it has topped out short term and might decline further within the falling wedge below the 50 EMA which means that altcoins might have some room to rally short term. I think this is in line with what is happening in EUR/USD and this is why I think BTC/USD might take a while before it declines.

Retail traders are beginning to get bearish on the market again and I think the market makers might have another surprise for them. Remember, at this point, the market makers are trying all they can to discourage traders from shorting the market. I think we would soon see them making another example of greedy bears trying to get in the way of another pump to the upside. If you are bearish but practice good risk management with low leverage than I think short selling here to add gradually to your positions in small quantities is not a bad idea.

Source link