Bitcoin (BTC) has declined well below ,000 in the last 24 hours which is apparently quite alarming but on closer observation, we see that BTC/USD has completed a major correction. This is a different outlook than the one that we would have in mind simply looking at the price and thinking it has fallen below the 50 Day EMA which has to be bearish. The price has indeed fallen below the 50 Day EMA but it has found support on the 38.2% fib extension level which is a sign of relief for the bulls and an indication that there is nothing much to worry about at this point now that BTC/USD has completed a major correction. In our previous analyses we called for this correction and it has yet to be followed by further downside but not before the price goes up first.

If we take a look at the daily chart, the price is trading within a falling wedge which could soon break to the upside and the price would then once again be trading above the 50 Day as well as the 21 Day EMAs. We can also spot a falling wedge on RSI which is another bullish indicator and a strong sign that the bulls need not to worry about further downside at this point. We do not expect the majority to stop panicking because if we take a look at the Fear and Greed Index it is down at 19 which means there is extreme fear in the market. Amateur retail bulls that are unnerved by a couple of dollars move to the downside will certainly be panicking right now, but for those that trade the market without any regard for FUD or FOMO, this could be an opportunity to buy.

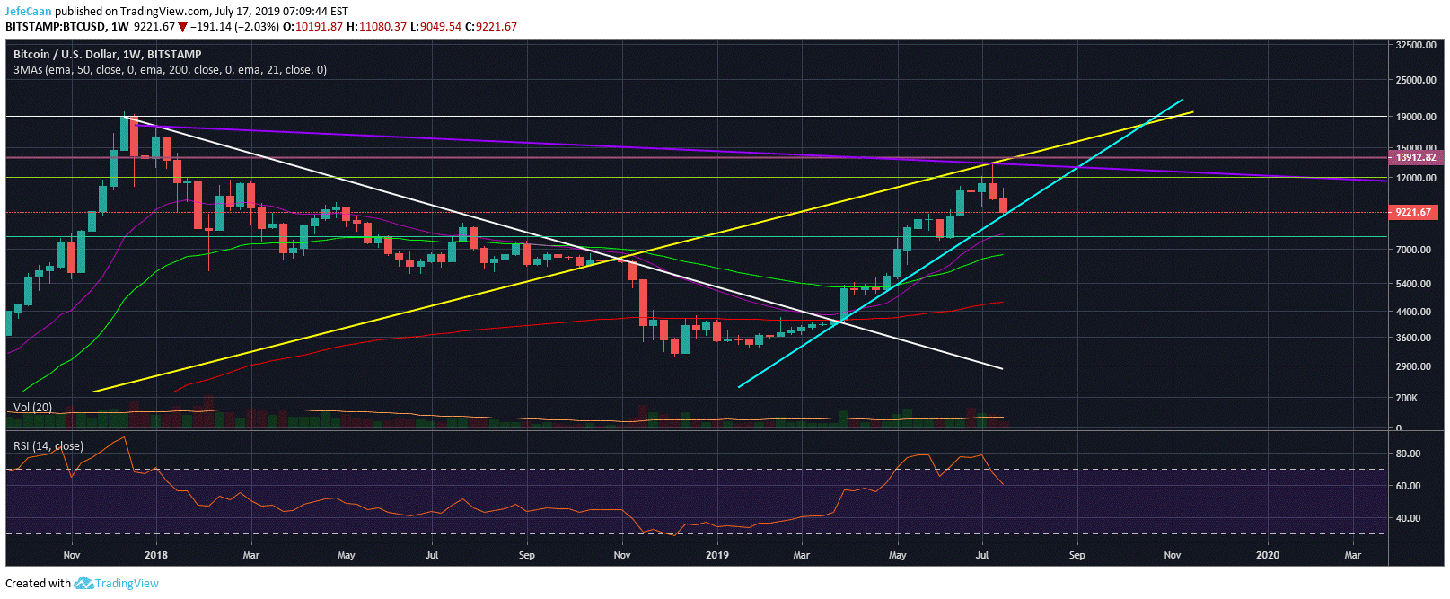

If we look at the weekly chart for BTC/USD, we can see that the price has declined to a key trend line support within a large rising wedge. We still expect this wedge to break to the downside but the price is likely to see further upside in this rising wedge before it falls. That being said, we do not expect the price to rally to a new all-time high or even a new yearly high. The price has topped out already and this short term relief rally will most likely be a bear hunt which will once again hunt bears that greedily entered ambitious short positions after the recent decline.

When the market makers are done shaking out the ambitious retail bears, we can expect the price to fall further. A lot of people expect the price to go down to $8,500 from here. That is still possible and we should be prepared for that eventuality but it will be too easy and the casinos will practically be giving away free money to the bears. It is in the best interest of the casinos to first see the bears being shaken out and then to have the bulls trapped as they expect the price to rally towards a new yearly high, before the price falls to $8,500 or lower levels.

Source link