Ethereum (ETH) has failed to capitalize on its break out of the falling wedge. The price closed the 4H candle above the 50 EMA and then pierced through the trend line resistance on the next candle. However, it failed to push further and has now once again been reduced to sideways movement. The 4H chart for ETH/USD also shows that the price broke below a key descending triangle but it did not fall as hard because we had a falling wedge in place that limited its decline. At the moment, it has failed to break past the 21 EMA on the 4H time frame which means that if it closes the candle in this manner, then further downside is to be expected.

It is pertinent to note that ETH/USD has peaked out here and the price has run into the top of the descending channel that it has been trading in. It has also broken past the top of the descending channel in the same manner that it did before. The last time it did that, we saw more than a 40% decline that was followed by some upside but eventually it had to decline to the bottom of the descending channel. Considering the overall state of the market, it is very likely that the same might happen this time with ETH/USD declining a lot more aggressively than Bitcoin (BTC) erasing most of its gains and potentially falling to a new yearly low. The probability of that happening remains low at the moment considering the pace of the decline and the fact that market cycles keep on expanding which means every move takes longer than before.

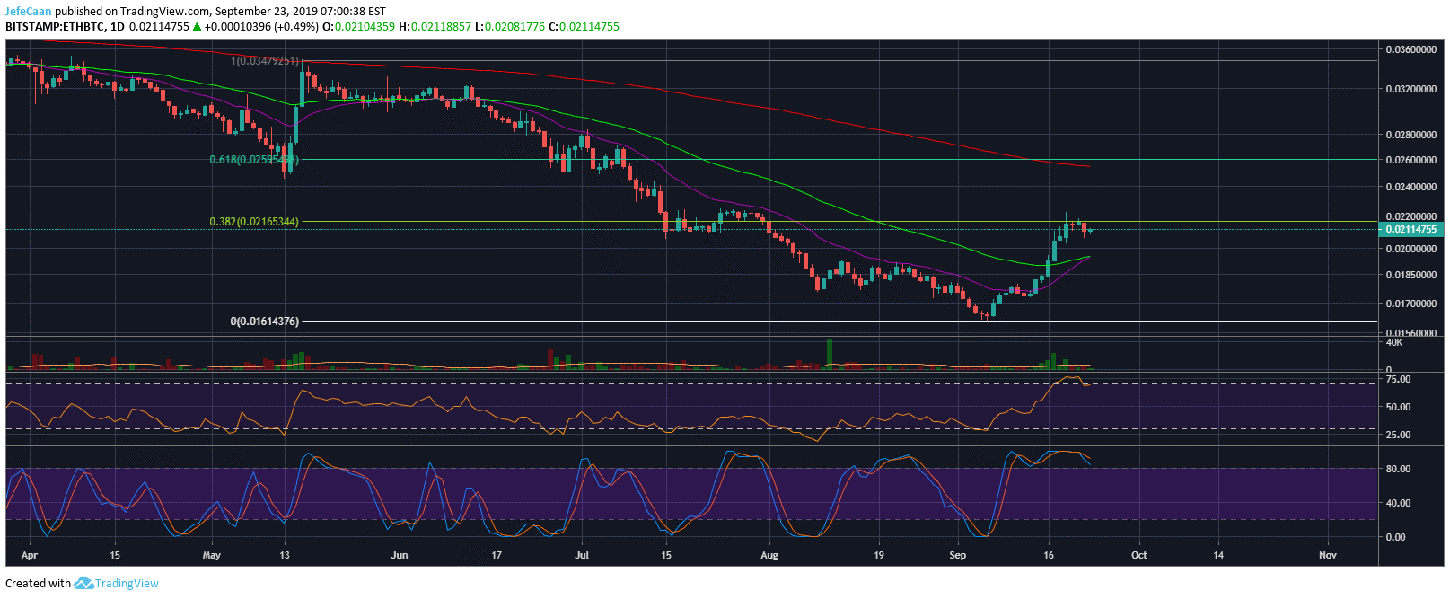

The daily chart for Ethereum (ETH) against Bitcoin (BTC) shows that the price has now run into a strong resistance at the 38.2% fib retracement level and is thus in no position to rally further from here. The Stochastic RSI warns of the looming threats and signals a sharp decline in ETH/BTC in the days and weeks ahead. This is to be expected because the manner in which Ethereum (ETH) pumped against Bitcoin (BTC) was neither organic nor sustainable.

Ethereum (ETH) and other altcoins fall harder than Bitcoin (BTC) most of the time during times of a downtrend. The same is expected to happen this time but it may take a while as dust settles around the Bakkt situation and the market takes a definitive direction. No matter how long it takes, the situation is very likely to play out as before and altcoins are expected to fall harder than Bitcoin (BTC) as indicated by a falling Ethereum Dominance (ETH.D) as well as the beginning of a downtrend in ETH/BTC. It would not be surprising at all to see ETH/BTC fall to a new yearly low but ETH/USD may not fall below $80 just yet. That being said, it is very likely to happen eventually and I expect Ethereum (ETH) to find its true bottom below $60 towards the end of this bear market.

Leave A Comment