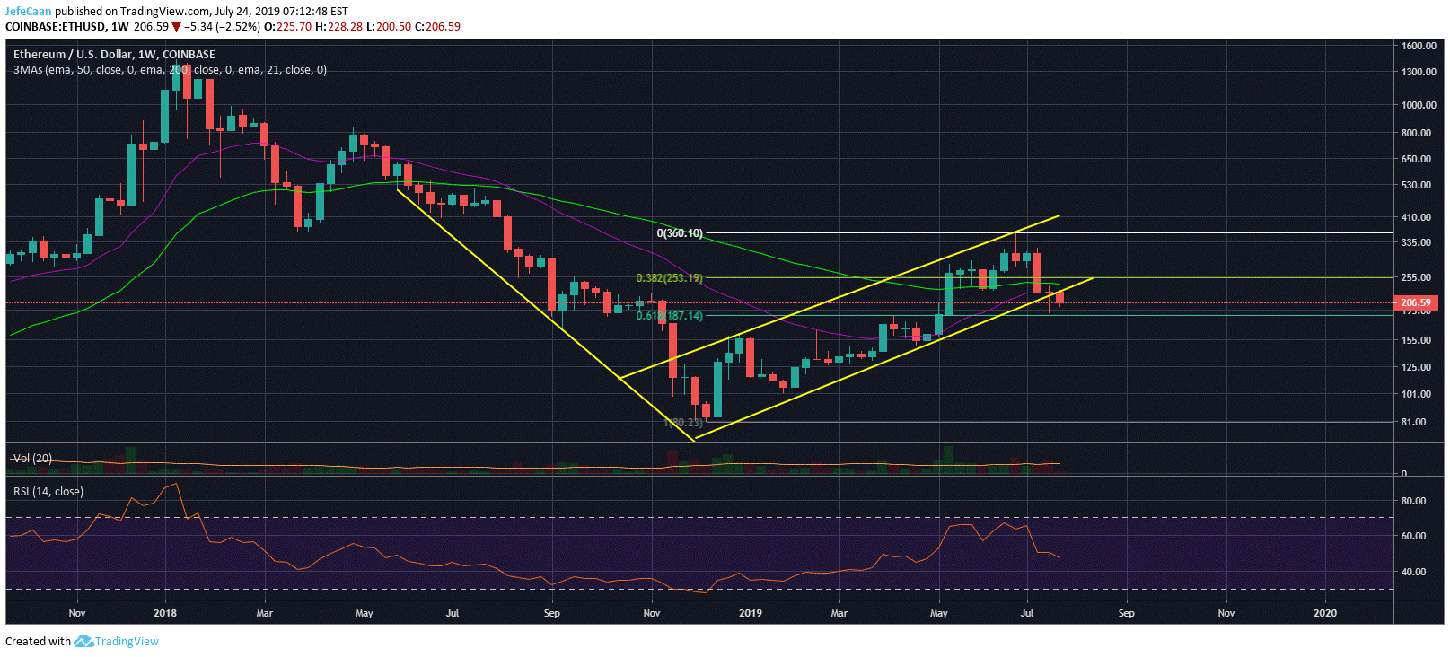

Ethereum (ETH) has long been stalling a move below $200. We saw it flash crash below $200 earlier but it managed to rebound from there without staying there for long. This was a temporary sign of relief in the market but it has now become clear that ETH/USD does not have the room to go higher and that the price is likely to crash hard soon as it declines below the 61.8%. This decline could see the price come down to $190 again any time before the end of the week. Now, we do expect the price to fall a lot lower than that before it finds its true bottom but that is for later to analyze and discuss. First, we need to see a break below the 61.8% and looking at the price action, it is quite clear that we are likely to see a break down below $200 before the end of the week.

The symmetrical pattern could come into fruition after the descending triangle effectively breaks to the downside and triggers another sharp downtrend. It is pertinent to note that yesterday ETH/USD held its ground better than Bitcoin (BTC) when most traders were expecting this correction to be a minor retracement but today we have seen ETH/USD decline more than BTC/USD. As Bitcoin (BTC) falls below the $9,600 mark, we are likely to see Ethereum (ETH) and other altcoins experience a lot of pain as they will decline much more aggressively. This could easily land Ethereum (ETH) at a double digit price towards the end of the correction. In our earlier analysis on Ethereum (ETH) this year, we pointed out that this bottom could be around the $60 mark. That still remains valid and we might see the price decline to $60 if not lower when the price bottoms.

The reason it is so likely for the price to decline to double digits again is because we are in a large bear flag on the weekly time frame. This bear flag has already broken to the downside and it is only a matter of time before we see a sharp decline below the 61.8% fib extension level. When that happens, we can expect the price to tank towards $80. Eventually, we expect it to fall a lot lower from there and our conservative target for ETH/USD is around $60 for its bottom.

Ethereum (ETH) is unlikely to see further upside from here, but there is a lot more downside to expect. From a risk reward standpoint, it does not make much sense to be bullish on Ethereum (ETH) at this point. The more likely scenario is for the price to decline from here beginning its next downtrend that could last towards the end of the year and possibly the first half of next year. It is pertinent to note that Ethereum (ETH) has already closed below the 50 Week EMA and is now likely to close below the 21 Week EMA (acceleration EMA). This means that the price could tank hard in the days and weeks to come.

Leave A Comment