Ethereum (ETH) staged a fake out and the price went on to break the downtrend as it climbed above the descending triangle. However, soon as it did that, the price lost its bullish momentum. The daily chart for ETH/USD shows a strong bearish divergence on the RSI. The price still remains in an uptrend and unless the short term trend line support is broken, we can still expect the price to rally towards the top of the large rising wedge once more. That being said, it is unlikely to break above it. Even the odds of a rally towards the top of this wedge remain very low as Ethereum (ETH) bulls are fleeing the ground and the bears are sharpening their knives.

The price of Ethereum (ETH) has found a good support in the 50 day moving average but soon as the price breaks below this level, the market is going to see some panic selling follow that could end up pushing the price below the 200 day moving average and eventually below the rising wedge. This is not going to be easy for most overly enthusiastic bulls that expect the price to shoot straight through the strong resistance zone and reach for a price of $300 per coin. This market cycle has to be longer than the previous one if the market is to follow its established order. That is the most probable scenario as Bitcoin (BTC) seems to have followed the 2014-15 cycle for the most part. If it continues to do that, we will have to see the current market cycle last longer than the previous one. Ethereum (ETH) remains heavily overbought on the daily and weekly time frames and is now primed for a major decline.

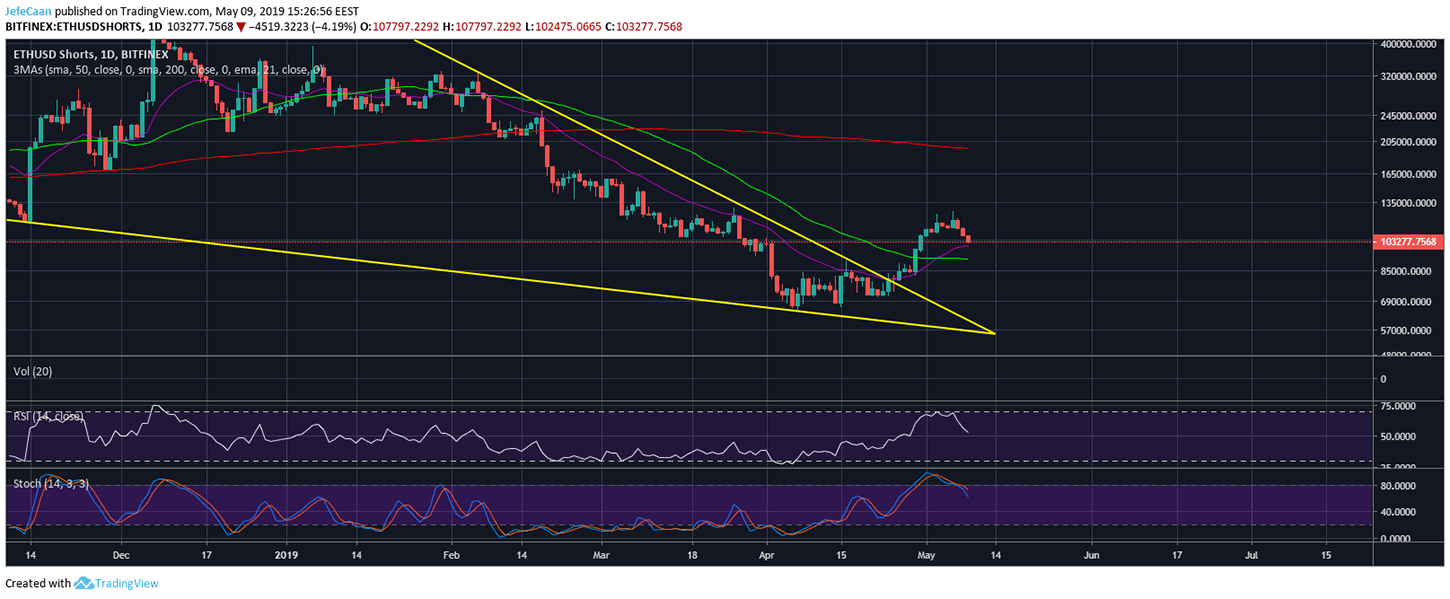

The daily chart for ETHUSDShorts shows that retail bears are finally beginning to lose interest as the price keeps on trading sideways. We mentioned in our previous analyses that this is going to make some bears realize that maybe they opened their short positions too early. As we can see, the number of margined shorts against ETH/USD is down more than 4% today and has found support at the 21 day EMA. We can expect it to decline further to the 50 day moving average but it is unlikely to fall much lower. The bears remain in control and we are likely to see them push harder in the weeks ahead.

Ethereum (ETH) remains a promising cryptocurrency project with a lot of potential in terms of adoption and partnerships. The price is down significantly from its all-time high and to a long term value investor this would be a good time to accumulate. However, for those that want to trade it, this is the time to be selling not buying as the price is likely to decline aggressively in the weeks and months ahead. The fear and greed index is at 69 today, the highest it has been in months. It shows that the majority is still too optimistic. Even news like Binance hack or WeChat bans have done little to affect the price. This indicates that we are a long way from the bottom yet.

Source link