Ethereum (ETH) has run into a strong resistance and now declined sharply below the $270 mark. This has left a long wick to the upside as the daily candle has now retraced below the 1.272% Fib retracement level. The price is likely to close below this level as it has run into the top of the ascending channel it has been trading in. It would appear that ETH/USD did actually profit a lot off the golden cross that most expected to be a bull trap. The price kept on rallying and pushed through critical resistance levels despite overbought conditions on larger time frames. This time however the price has completely run out of any room it has for further upside. The rejection at top of the ascending channel is testament to the fact that ETH/USD has now run out of steam and the price is likely to drop to the bottom of the channel.

RSI on the daily time frame for ETH/USD is extremely overbought and signals a decline in the price of Ethereum (ETH) in the weeks ahead. The price may not decline in the same manner that it shot up but it is clear that once Ethereum (ETH) declines from current levels to the bottom of the channel, it is more likely to fall further as the price has now formed a large bear flag that could break hard to the downside. This breakout to the downside has been discussed in our previous analyses on Ethereum (ETH) for a long time now. We expect ETH/USD to find its true bottom around $60 or lower levels by the end of the year. Considering how the price shot up during the past few weeks, it is likely that this correction might take even longer as the whales have prolonged the ongoing market cycle.

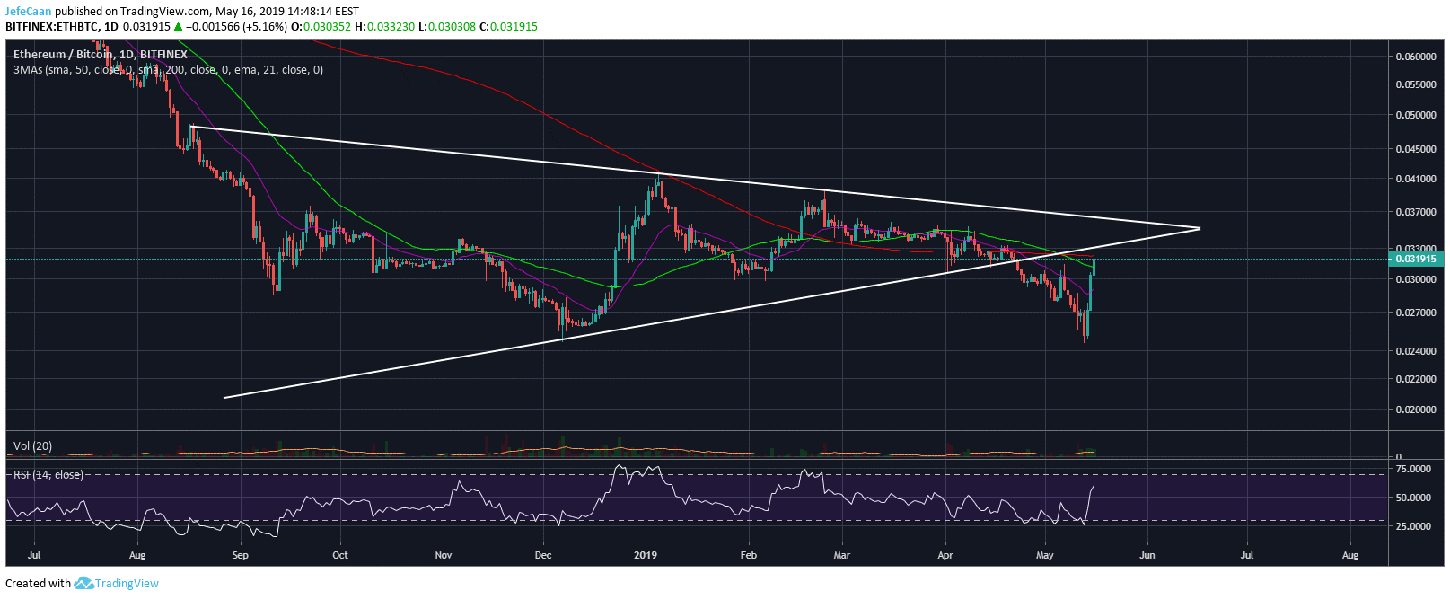

The daily chart for ETH/BTC shows that Ethereum (ETH) has faced a strong rejection at the trend line support turned resistance and the 200 day MA at the same time. This confluence of strong resistance levels has made it extremely difficult for Ethereum (ETH) to climb back into the bearish pennant that it broke below. If things remain the same, we would expect ETH/BTC to begin another downtrend from here that would push it towards new lows in the months ahead. Ethereum (ETH) has seen parabolic growth these past few weeks but this is not a sign, it’s bearish. We have shot up through critical resistance levels without any significant hindrance which has turned the crowd way too optimistic.

Even some of the most respected traders are giving in to this desperate buying frenzy as they are making the same mistake of thinking maybe this market is different. A lot of people made this mistake when they bought Ethereum (ETH) around $400 thinking this market cannot fall further because it is different and that there is a lot of interest in Ethereum (ETH) and blockchain technology. However, as they found out the hard way markets do not care about all that. There is a cycle that has to follow through whether people like it or not. Ethereum (ETH) is still in that cycle and it is a long way from coming to an end just yet.

Leave A Comment