Ripple (XRP) has just faced strong rejection at a critical trend line resistance next to a bearish Ichimoku cloud that the price is extremely unlikely to break past at this point. As XRP/USD goes down, it will become easier to eventually break past this cloud. So far, the price has shown no signs of a bullish continuation. We are likely to see XRP/USD decline to the bottom of the descending triangle. This might result in a break below the triangle to the next key support just below $0.15. Ripple (XRP) has avoided most of the brutal downtrends of the ongoing bear market as it has made independent moves time and time again. When Bitcoin (BTC) and the rest of the market was in free fall, there were times when XRP/USD was doing exceptionally well. However, since the beginning of the year buying interest in XRP/USD seems to have declined.

The weekly chart for XRP/USD shows that the price consolidated above the key support at $0.286 before it shot up towards the 50 week moving average and settled above it. A lot of bulls are still excited that this could lead to bullish continuation and XRP/USD might eventually break past the trend line resistance to begin a new bullish cycle. Most of the retail bulls choose to ignore key technical indicators against their own bullish bias based on blind faith and wishful thinking that the price is going to keep on pumping as it has in the past few weeks. What most retail traders don’t realize is that the stakes are too high this time. This is not just some tech geeks buying and selling to swing prices up and down. Institutional investors and big players are part of the game now that couldn’t care less about FUD or FOMO.

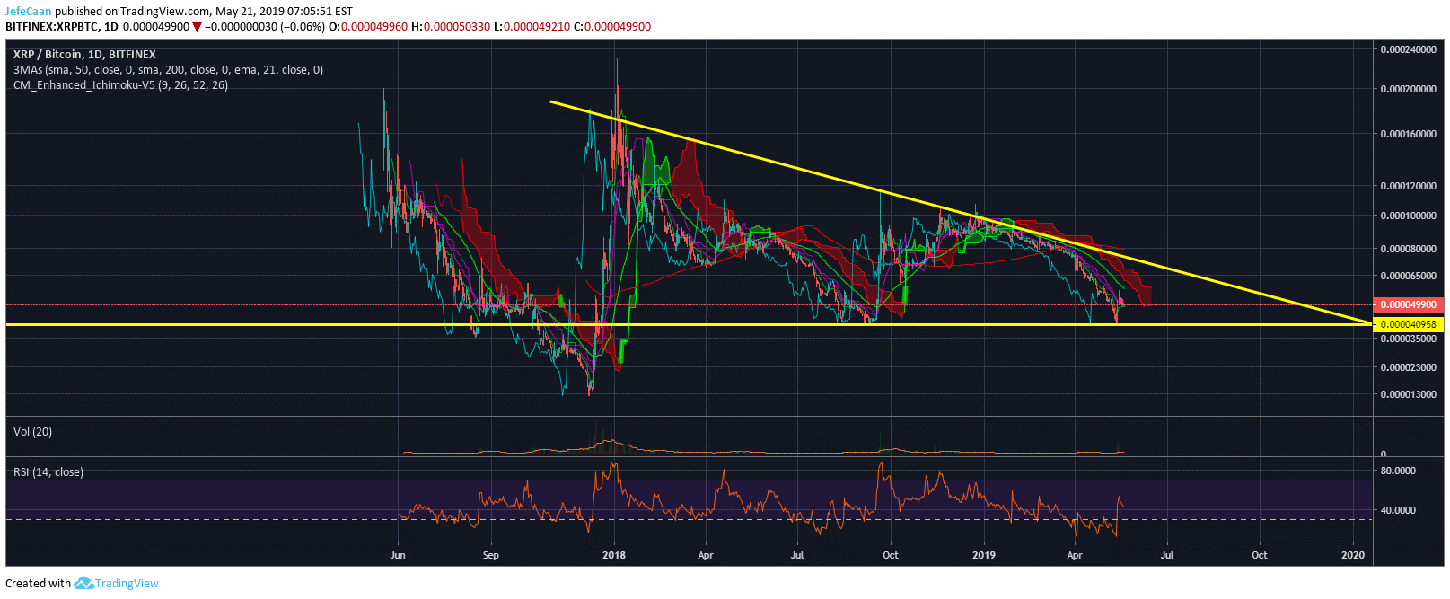

Ripple (XRP) has also run into problems against Bitcoin (BTC). If XRP/USD breaks below the descending triangle, we might see XRP/BTC do the same. The price has failed to break past the 50 day moving average and it is likely to face stern rejection on another attempt as the Ichimoku cloud is getting wider. RSI on the daily time frame for XRP/BTC has a strong bearish divergence that signal a decline towards the bottom of the descending triangle. The more the price retests the bottom of this triangle, the higher the probability that it is eventually going to break below it.

Unlike most cryptocurrencies, Ripple (XRP) has had a hard time outperforming Bitcoin (BTC) since the beginning of the year. This can be attributed to a decline in buying interest but Ripple’s legal troubles, ambiguous legal status of XRP and discrepancies in Ripple’s reports regarding its XRP escrow release are key factors that have seen Ripple (XRP)’s performance decline. Ripple (XRP) used to be the cryptocurrency that would jump ahead of the market and lead rallies but unfortunately it seems to have lost that status. Ripple (XRP) still remains a promising blockchain project and it is likely to remain the third largest cryptocurrency by market cap for now.

Leave A Comment