Bitcoin (BTC) has declined below the 38.2% fib extension level and is now eyeing a decline below the 61.8%. If BTC/USD does fall below that level, we might see it decline temporarily towards the 200 EMA on the 4H time frame before it eventually declines further and completes the current correction just below $8,000. This would be the steep move to the downside that we expect which will most likely be followed by a pump to the upside. After that, we will see another gradual decline kick in. Now, this is what we see on the shorter time frames and if we choose to ignore what is happening on larger time frames, then it is easy to be tempted to believe that the price might recover sometime soon.

The majority of retail traders already believe that the bear market has ended and the price is due only for a minor retracement before it flies towards a new all-time high. One thing that is very important to realize is that retail traders never beat the market makers at their game. If we were to assume that the bear market has in fact ended, then the retail traders have won and the market makers have lost, but this is not how it works. This is the same game that has been played over and over again for decades and it works like a charm every single time. In every sucker’s rally like this, the average Joe or quick buck artists get very excited and they FOMO into the market. Then when the price begins to decline by a few hundred dollars, they get out then they get back in to the market at a higher price. The market makers just love these fickle traders.

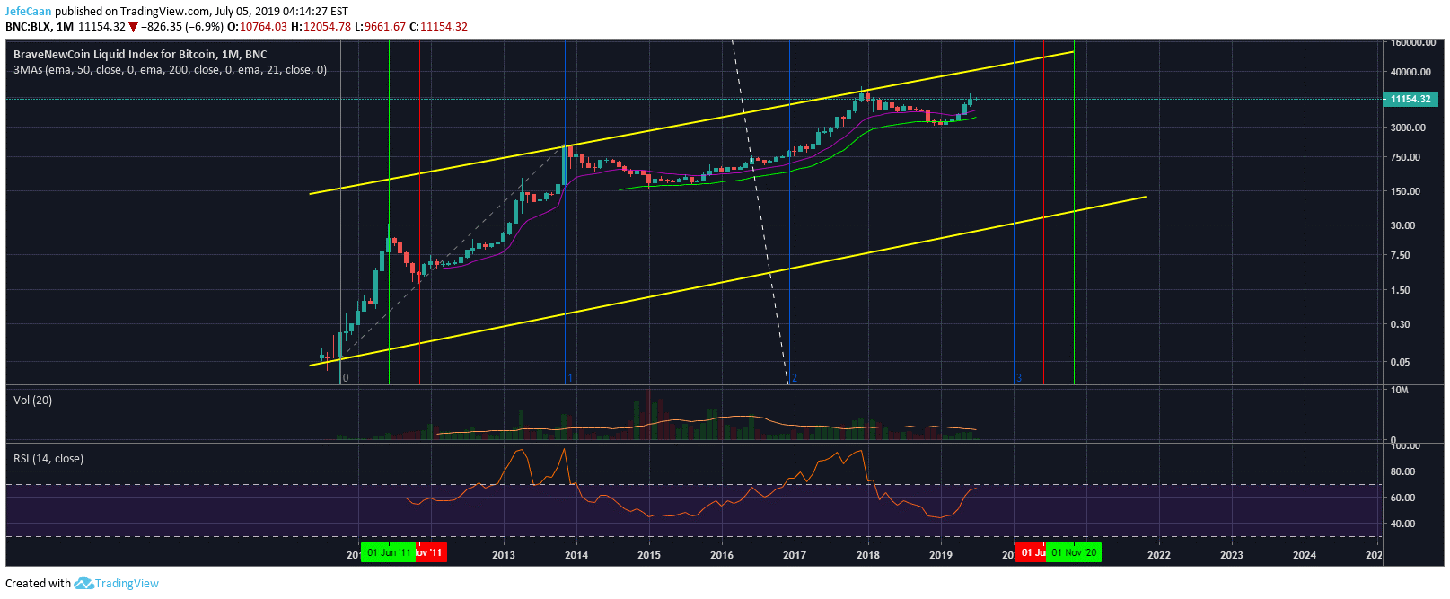

Now, here is where it gets interesting. Just, when everyone is expecting another bull run, we see this on the monthly time frame. If we take a look at this chart, we can see that a dashed line divides the fractal into two parts. This chart shows that there is a high probability that the Bitcoin (BTC) bubble might finally pop this time. We could see BTC/USD decline all the way towards its next halving in June, 2020. Then we might see a small relief rally which could then be followed by the major downtrend that will see the bubble pop.

Most Bitcoin (BTC) enthusiasts consider it as a standalone asset immune to movements of major markets or developments on the global political and economic scene. This could not be further from the truth. No matter who gets elected President of the United States in 2020, we are likely to see some sort of conflict in the Middle East that could escalate into a full scale war. This is very serious and the threats are quite real. If something like that happens, we might see Gold and Silver rise further while the stock market crashes. As for Bitcoin (BTC), nobody will even care what happens to it except for a small group of people who control the price who would have already dumped it all on the overly ambitious bulls by then.

Leave A Comment