Bitcoin (BTC) is crawling towards the $5,800-$6,000 mark but it running out of steam to retest that zone because the price is massively overbought and no professional traders or investors would want to touch it around these levels. Even those bullish on BTC/USD thinking the bottom is in realize that the price is due for a major retracement and we could see it anytime now. It is important to note that the price is trading at a $300 premium on Bitfinex which means we could see the price hit the $5,800-$6,000 zone a lot sooner than on other exchanges and the price may start to nosedive while investors are waiting for a rally to $5,800-$6,000 on other exchanges. All things considered, the potential for further upside from current levels is extremely know and both the bulls and the bears know this. The price is expected to crawl and not run towards the resistance zone because buying Bitcoin (BTC) at this point is very risky.

To the upside, BTC/USD could make a $500 move and test $5,800-$6,000 but to the downside, the price could easily decline more than $1,000 in value. This makes it a poor investment simply from a risk/reward standpoint even if we do not take other indicators and overbought conditions into account. The S&P 500 has been trading in a rising wedge and is primed for a big fall. The moment it starts to decline, we will see BTC/USD follow suit. That decline is very probable in the month of May as the Iran Oil Waivers will expire tomorrow. This would put a lot of pressure on countries like China to stop buying crude oil from Iran. Considering that Iran is one of China’s target markets for its future plans as part of the Belt and Road initiative, it is very likely that this whole oil sanction fiasco will lead to some friction between the US and China and so the trade war might start again.

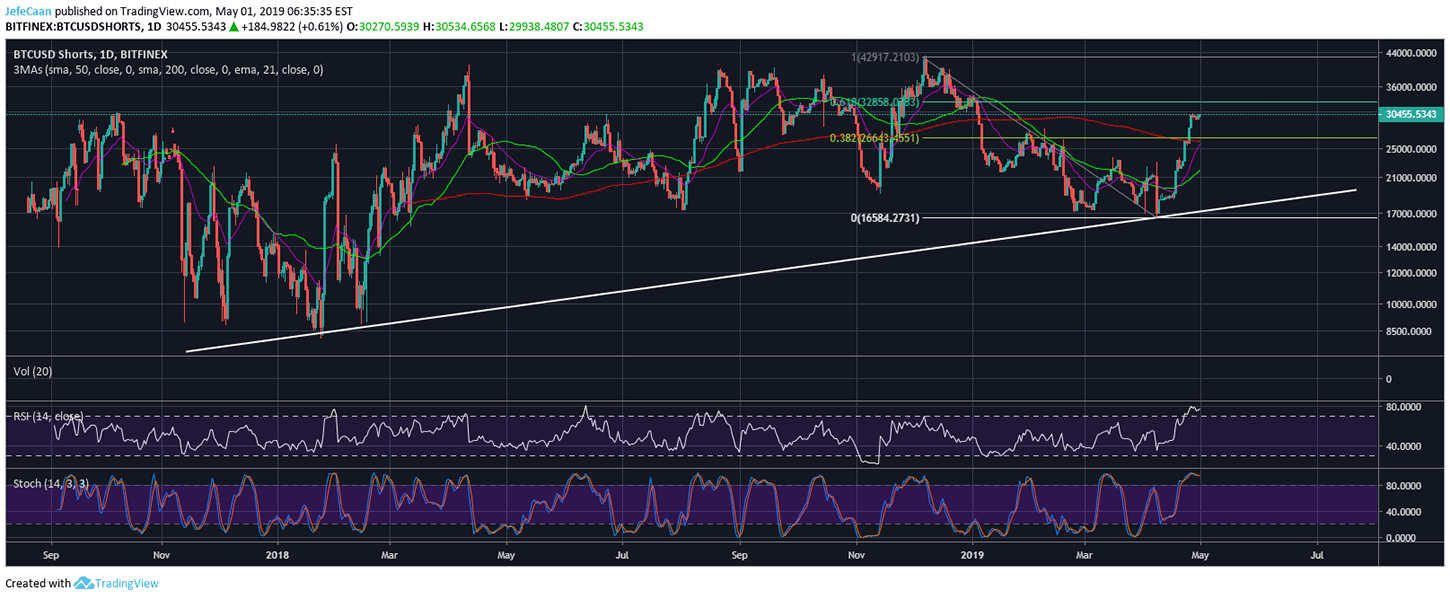

The daily chart for BTCUSDShorts shows that the number of margined shorts has been rising aggressively since last month. This does show that the bearish momentum is rising but it also shows that the bears have become too excited at the wrong time. The price of Bitcoin (BTC) may still have room to rally and the fact that BTCUSDShorts is about top out on the daily time frame is alarming. That being said, the number of margined shorts could still increase despite short term overbought conditions but it does not have much room.

On the other hand, BTC/USD could take a long time before the $5,800-$6,000 zone is tested. This may annoy the bears and lead to a decline in the number of margined shorts. The game plan is very clear at this point and all things point to one conclusion that is an inevitable decline in the price of Bitcoin (BTC) in the days to come regardless of what price level it reaches before it happens.

Leave A Comment