Bitcoin (BTC) risks a sharp decline over the weekend even under the bullish case. This might be a similar correction to what we have seen before when the price declined below the previous descending triangle. At the moment, there is not enough bullish momentum for the price to break out of the falling wedge that it is currently trading in which is why there is a strong probability that we might see a sharp break out down to the bottom of the falling wedge. RSI on the 4H time frame is in favor of such a move and the same goes for the Stochastic RSI. This decline would pull the price down to $7,200 or lower within the falling wedge and prepare it for the long anticipated correction to the upside.

While the upcoming correction in BTC/USD has a strong probability of coming to fruition within the falling wedge without having to decline much further, it is still possible that we might see a wick below $7,000. Investors that are trying to buy the dip at current levels would find it to be quite risky because the moment we see a decline below the 21 EMA on the 4H time frame, I think we would see a long red candle to the bottom of the falling wedge. You might not want to be holding any Bitcoin (BTC) or other cryptocurrencies when that happens. That being said, it might be a good idea to buy once we see a break out of the falling wedge. It is very important to realize that before we see a break out of the falling wedge, there is no reason to be bullish on Bitcoin (BTC).

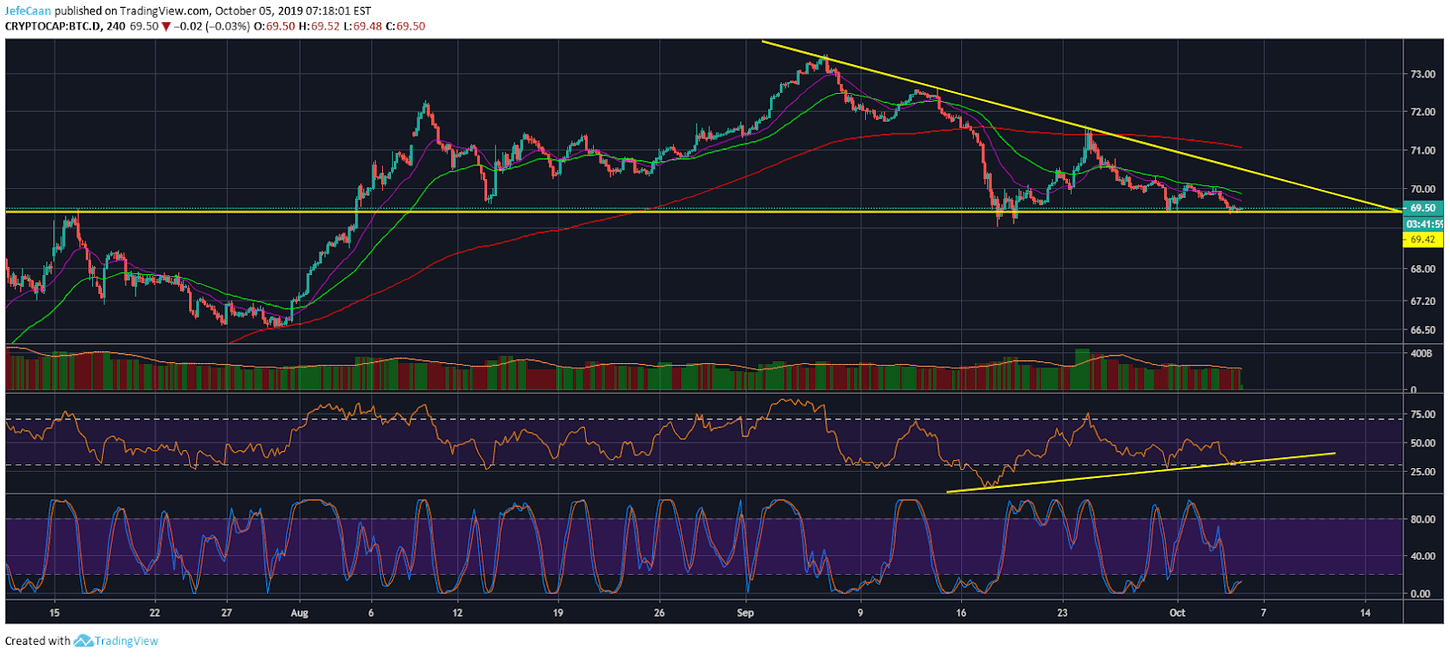

Bitcoin dominance (BTC.D) has been in a downtrend but it has now found a strong support. It is likely to keep on surging higher as we see the cryptocurrency market resume its downtrend after prolonged indecision and sideways movement. There is also the possibility of a break below the descending triangle but I think that would open a whole new chapter and invalidate everything that has been happening in the past few months which is why I think the probability of that happening is extremely low.

The most probable scenario at this point is that we might see a sharp decline in the cryptocurrency market and Bitcoin dominance (BTC.D) will rise as BTC/USD holds its ground better compared to other cryptocurrencies. RSI and Stochastic RSI on the daily chart for Bitcoin dominance (BTC.D) are both in favor of such a move. It is therefore important to remain focused on this chart and realize that Bitcoin dominance would only be rising if we were to see another decline in the market. As the 4H chart for BTC/USD points to this probability, therefore we are more inclined to believe that a sharp decline is very likely to follow from this point forward and it might come to fruition over the weekend.

Leave A Comment