Bitcoin (BTC) could flash crash to a four digit price, but why? Let us set the technicals aside for a while and look at this from a psychological standpoint. When the price was breaking past $10,000 for the first time after the bear trend, a lot of people expected there to be significant selling around this point as it would be a strong psychological barrier, but instead we saw more pumps to the upside. If we take a look at the daily chart for BTC/USD, we can see that there is no red candle in sight between $10,000 and the local top. This was made to happen for a reason and the reason was to let everyone think that we are in a bull market and this parabolic uptrend could push the price to a new all-time high this year. So, did the market makers succeed in building this narrative? Yes, I think they did.

The price declined to $11,000 and then shot back up to rise to a new yearly high but it failed and instead declined to the 50 Day EMA. Now those that are still bullish and believe this to be the beginning of a new bullish cycle have their stops very close to the $10,000 mark. They expected the 50 Day EMA to hold and that is reasonable to expect because if the price is in a bull trend then it should respect that level. Now, the problem is that most of these overly ambitious traders have poor risk management strategies or no strategies at all. So, if the price crashes to $10,000 they are helpless and then their stops are hit and the price tanks further. For the market maker, there are two reasons to do this. First of all, they want to make free money putting you out of your positions by hitting your stops. Second of all, they want to flash crash the price so the shorts don’t pile up.

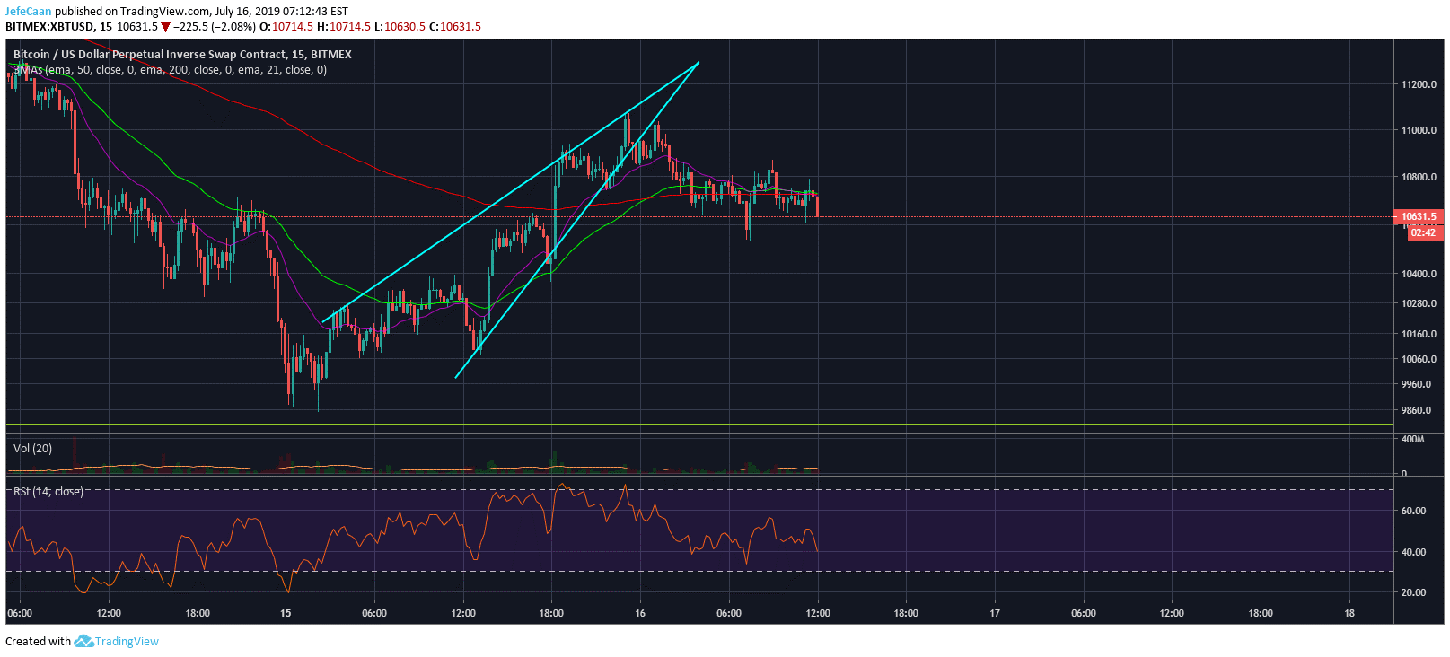

On the smaller time frames, we can see that BTC/USD has already started to decline after breaking out of the rising wedge and is now expected to fall further. If we take a look at the daily chart once more, we can see that the NVT indicator on that chart has finally declined below its RMA. This is a good indicator that the bears are now ready to strike at a time and place of their choosing. Well, not the bears but the whales to be honest because most of the bulls and the bears eventually get slaughtered; only the whales make money.

Soon as the price declines below the 50 Day EMA, all hell is going to break loose and it would not be surprising to see the price fall straight towards $7,290 which is around the 61.8% fib extension level from the beginning of the parabolic advance. A lot of bulls are still in denial and they will continue to be in denial. Some might have learnt their lesson from the previous bear trend and sold at the top or even current levels while others would repeat the same mistake they made last time and think of every dead cat bounce as the beginning of a new bull trend until it is all quite clear and then it will be too late to sell.

Leave A Comment