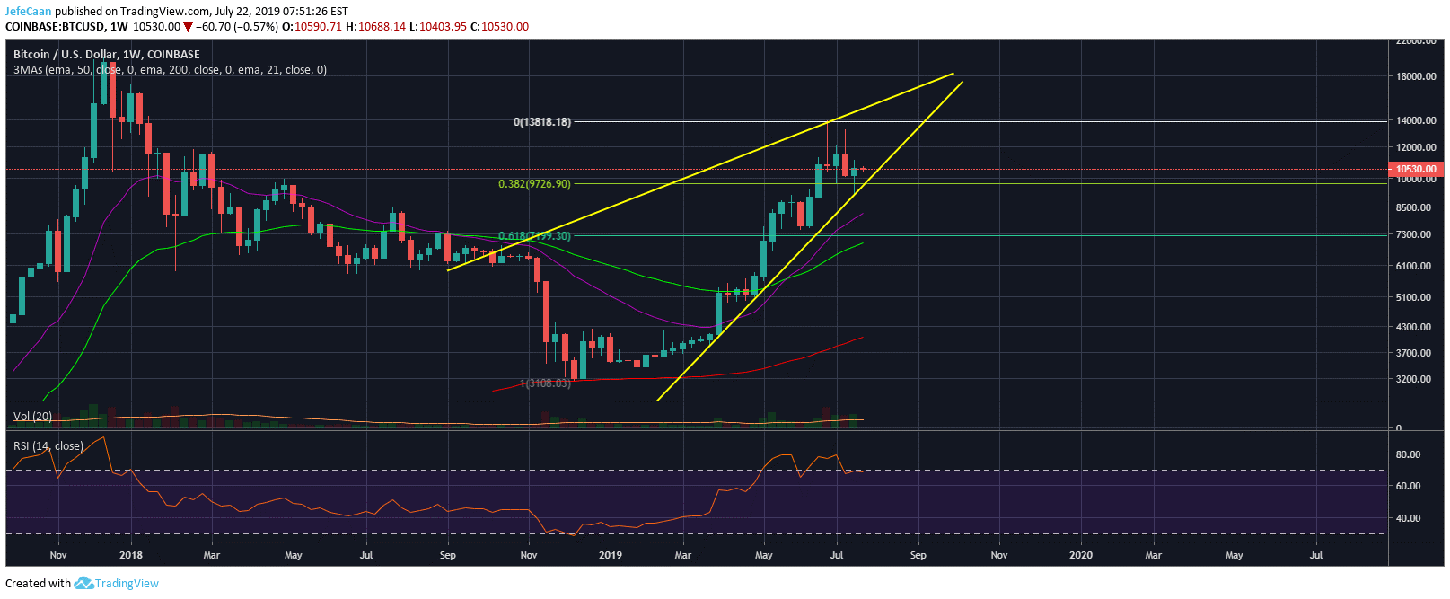

Bitcoin (BTC) is expected to decline further as the price has run into the strong 38.2% fib retracement level from the local top and already retraced from there. The price is now below the 21 day EMA and will not need much to happen in order for it to decline below the 50 day EMA. We could see sideways movement for a while but ultimately that decline is very likely to happen. The bears are eyeing this level eagerly because if the price closes below the 50 Day EMA, the bulls will lose control of the price. The thing is, those that are looking to profit off this move many not be able to do so very efficiently if the price slides below the 50 Day EMA because this move is likely to be a very sharp one that might see the price decline to $7,200 very quickly.

At this point, a lot of retail traders are waiting for BTC/USD to fall and if it were to decline below the 50 Day EMA, close there, and then begin a gradual downtrend, it would be allowing a lot of retail traders to profit off the move. History tells us that this is rarely the case. It is in the interest of the exchanges to discourage shorts from piling up and this is why we are more likely to see a quick crash rather than a gradual decline. Patient traders are more likely to come out as winners here because we might see some sideways movement before that happens and a lot of people will give up hope. The next downtrend in Bitcoin (BTC) is going to formally kick off the beginning of a second bear trend that is going to last another twelve months if not longer.

Bitcoin (BTC) has been long overdue for a sharp decline as the rising wedge on the weekly chart indicates. Certainly, there is still plenty of room to go up within the wedge but looking at the weekly closes in the past five weeks, there is no reason to believe we could see a new yearly high or a new all-time high in BTC/USD this year. The most likely scenario which by the way is also an eventuality is a break below this rising wedge. It is not a matter of if but when the price will break below this wedge.

The moment we see the price slide below the 38.2% fib extension level from the December, 2018 lows, the price will exit the rising wedge and formally begin the next bear trend. The immediate stop would be the 61.8% which comes down close to $7,200 but eventually it will decline a lot further. The price could stage a relief rally from there but it is unlikely to break past $10,000 when that happens. Further downside will be more of a slow bleed that is going to last another twelve months till Bitcoin (BTC)’s halvening in June, 2020.

Leave A Comment