Ethereum (ETH) has finally shown signs of weakness after a strong move to the upside that surprised both the bulls and the bears. Earlier this month we discussed the possibility of ETH/USD breaking out after it broke out of the falling wedge. However, the price action was far too weak for that to happen as it kept on facing rejection at the 21 day EMA. The price had to test the top of the descending channel but the manner in which it did that was a classic case of market manipulation. A lot of bears were shaken out as the price kept trading sideways with big pumps to the upside one after another. This is not what organic buying or selling looks like.

All that aside, Ethereum (ETH) achieved the objective which was to get retail investors to buy bags of useless coins from the whales. Buying and selling Bitcoin (BTC) can be easily done on OTC exchanges without influencing the price. So, if you are a whale and you have to unload you bags, you can do it on an OTC exchange without worrying about tanking the price. However, if you are a whale and you want to dump altcoin bags, you cannot do that during a downtrend or an expected downtrend because you would be selling directly on exchanges and that would mean affecting the price. So, the best way to do it is to inject fake bullishness in the market and get everyone to think that an altcoin season is around the corner. That way as you sell, retail traders will readily buy your bags.

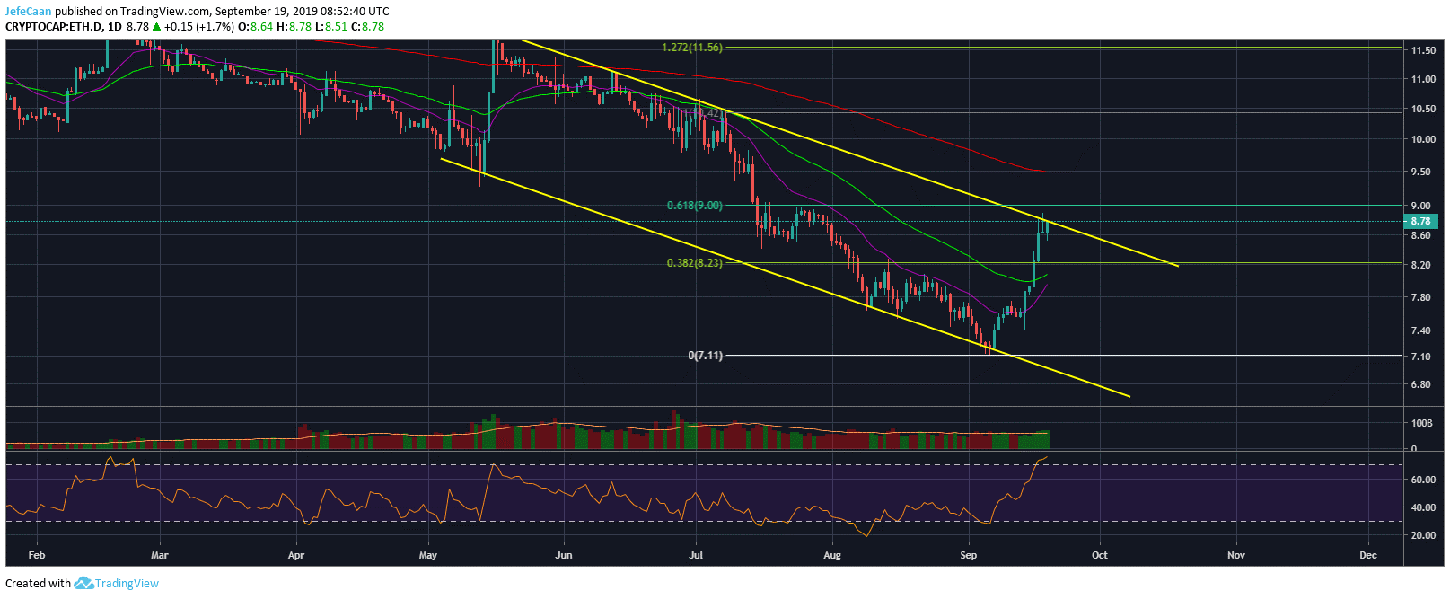

The big picture is always very clear and straightforward. If we look at the daily chart for Ethereum Dominance (ETH.D), we can see the descending channel very clearly. Now, the mistake a lot of traders make is that they try to catch tops and bottoms. If you made that mistake here then chances are you sold too soon. It is very important to realize that you don’t have to catch tops and bottoms to be a successful trader. In fact, if you keep doing that, the probability of you becoming a successful trader would be very low because you might get lucky once in a while but then you will lose most of your gains.

It is therefore more important to focus on the moves in between. To that account, we need to stay focused on what happens to Ethereum Dominance in the days ahead. We are looking at two scenarios here. Either Bakkt is bullish for Bitcoin or it turns out to be a false hope and it is bearish. In both cases, Ethereum (ETH) does not have much to gain from all this. If Bakkt is bullish for Bitcoin, Ethereum (ETH) will suffer and if Bakkt is bearish for Bitcoin (BTC), Ethereum (ETH) will suffer. So, there is not much reason to be bullish on Ethereum (ETH) at this point. A lot of traders were lured into longing Ethereum (ETH) due to favorable funding rates but funding rate is not going to matter much when your investment potentially loses 40% of its value from current levels.

Source link