Ethereum (ETH) longs are up for the first time in more than a week. This is a sign of relief for the bulls who have been losing ground despite oversold conditions short term. The daily chart for ETHUSDLongs shows that the number of margined longs has now declined to a trend line support and having formed its first green candle in more than a week, is expected to rally ahead. Ethereum (ETH) bulls are likely to capitalize on this and we might see a rise in the number of longs as ETH/USD starts to rally. However, this should not mislead traders into believing the bear market is over, because it is not. The price of Ethereum (ETH) has not been this overbought on the weekly time frame throughout the bear market.

The sentiment remains too bullish and the market does not seem to have inflicted maximum pain just yet. Even the Bitfinex-Tether controversy had little impact on the bullish resolve. We have seldom seen markets recover when the sentiment is so optimistic. Those of us who have been around during the previous market cycle of 2014-15 might be able to recall that after the Mt. Gox hack it felt like the end of Bitcoin (BTC). The sentiment was too pessimistic when the market was about to see a trend reversal. Very few people wanted anything to do with Bitcoin (BTC) or other cryptocurrencies. However, this time around the situation seems to be entirely different. Not only is the sentiment too optimistic around the supposed trend reversal but the market cycle is also shorter than the preceding cycle which has never happened in the history of cryptocurrencies.

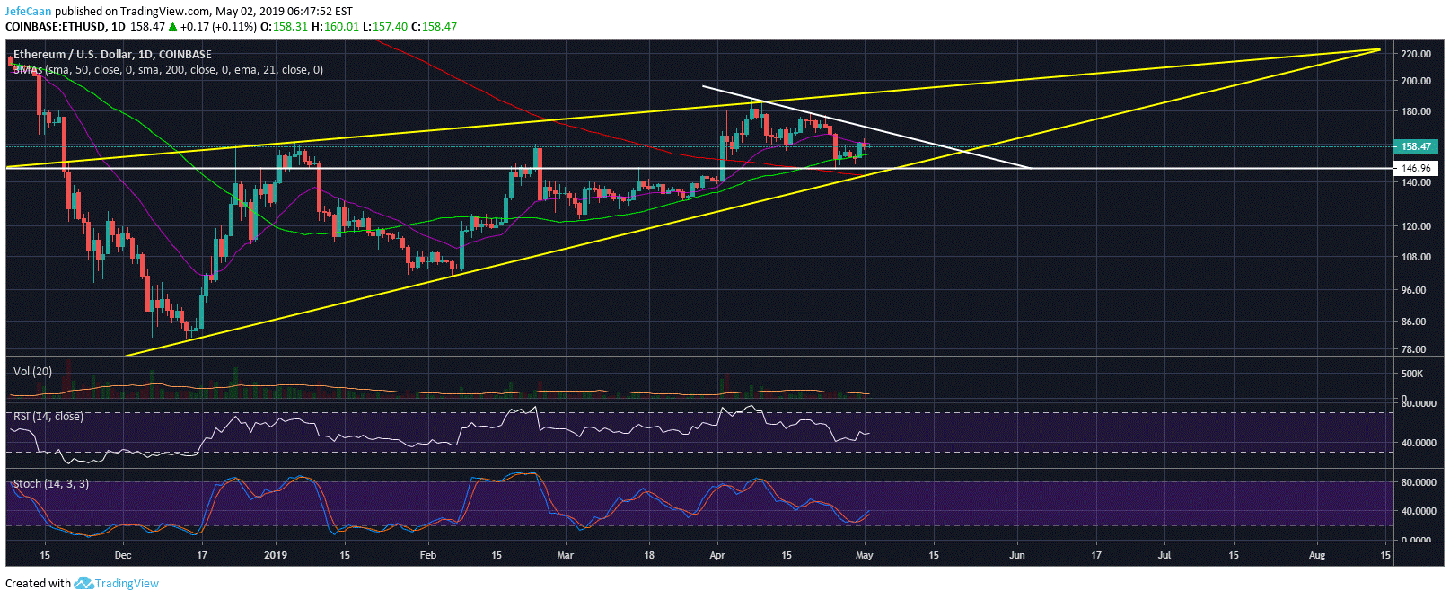

For investors that want to dollar cost average their entries, it may still be a good idea to buy some Ethereum (ETH) when the price declines below both the descending triangle and the rising wedge on the daily chart for ETH/USD. That being said, the price is very likely to fall a lot lower, even below $60 in the weeks and months ahead. A lot of cryptocurrency traders and analyst look at cryptocurrency charts as a standalone market immune to the effects of global economic and political tensions. This is not the case and as we have seen in the past a decline in the S&P 500 has a strong impact on the price of Bitcoin (BTC).

Waivers on Iran’s crude oil imports are set to expire today. There are a lot of geopolitical tensions that could spring up in the aftermath of this development. Most of those events like a rise in oil prices or growing tensions with China will impact the stock market in a big way. It is very unlikely that Ethereum (ETH) or any other cryptocurrencies will be able to hold their ground when the stock market starts to decline. Meanwhile, the Federal Reserve is also busy unwinding its balance sheet till September. So, there is no reason to believe that the market is going to turn bullish any time soon. If anything, Ethereum (ETH) investors should expect further downside in the weeks and months ahead.

Leave A Comment