The obvious never happens in any market unless the market makers want that to happen. Why would the market makers want to let the obvious happen? To instill confidence in the market and make retail bulls more confident or let’s say complacent. The recent break above the ascending triangle was too obvious but it did come to fruition quite cleanly and a lot of retail bulls feel like geniuses right now just because they could predict the price to break out of some lines on a chart. Make no mistake, technical analysis is a very important part of trading research but a lot of people lay too much emphasis on it. A lot of people can draw good charts but most of them don’t make money off it. This is because trading is about more than just drawing charts.

If we look at the weekly chart for ETH/USD, we can see that the move the price made recently was probable. It was on the charts as a possibility and anyone that discounted that possibility would be better off investing for long term instead of trading. Looking at the charts, we can see some more possibilities. First of all, the price is likely to come down to the bottom of the ascending channel at some point. Second of all, it has now run into a strong trend line resistance which it will find very hard to breach. This means that the probability of a fall from current levels is higher than the probability of a rise. See, this is not about charts or some lines on a chart. There is more than that to this game. That’s right it is a game where the big players play the small players and wipe them out in turns. They pump the price up and shake out the bears and then crash it down to shake out the bulls. At the end of the day only the casino and the people who understand the workings of the casino win.

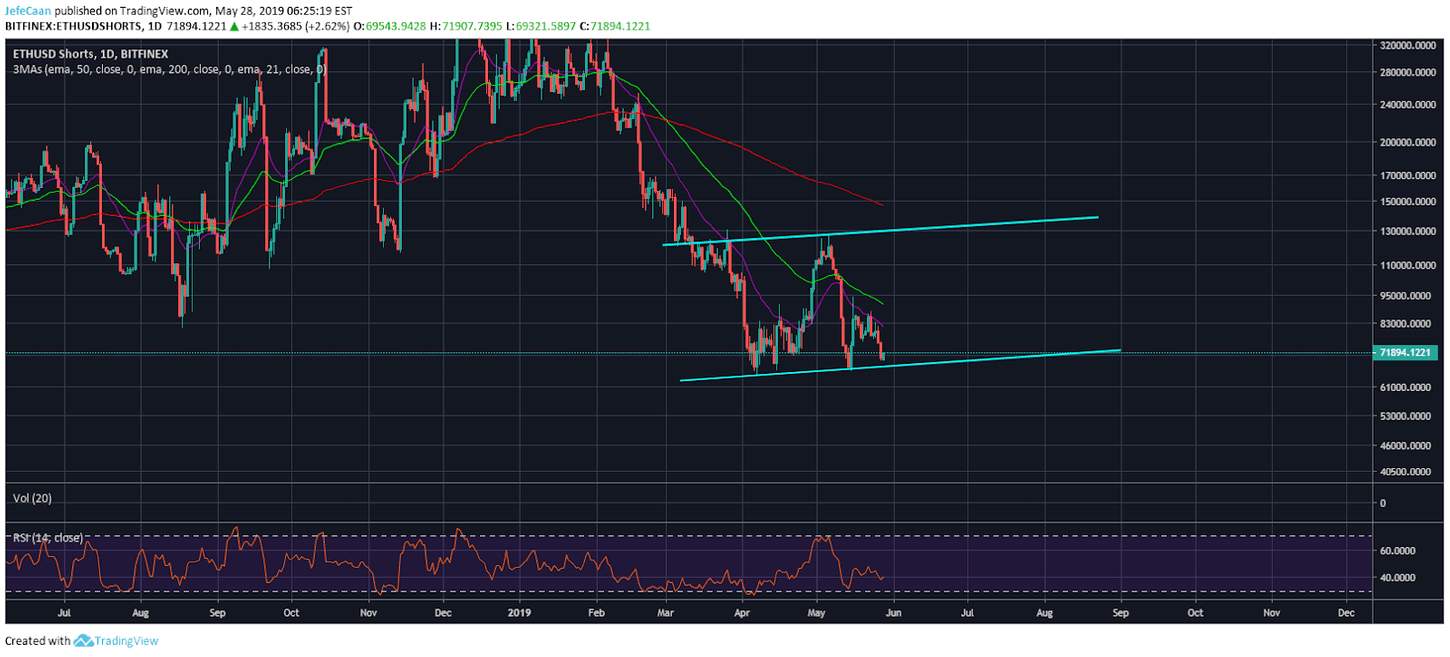

When ETHUSDShorts rises too high and everyone is shorting Ethereum (ETH) on margin especially when the price looks too obvious to fall, this becomes a challenge for the casinos as they cannot allow that to happen. If the price did fall just as most of the bears expected it too while they were shorting on margin, they would clean the casinos out and put them out of business. Same thing works the other way. Let’s say someone sees the price fly past $170 and all of a sudden they think to themselves “the strong resistance is broken, this means the bull market has begun”. So, they go long on Ethereum (ETH) on margin.

There are a lot of people who have done that in the past few weeks. Now, the price of Ethereum (ETH) is trading around $270, if it were to go straight to $300 from here which is a psychological sell level for many of these traders, most of them would close their margined longs and the casino would be in big trouble. This is why it is important to the casino to take these small players by surprise and pull the price back to levels where they shorted from. They will end up hitting their stops so they are out of their margin positions. When that is done, they will slowly pump the price back to $300 or beyond. After that, when everyone starts to FOMO back in, they will finally dump their bags to pull it down to a price where most of these FOMO buyers wouldn’t want anything to do with it.

Leave A Comment