Ethereum (ETH) and other altcoins are at a very interesting point. The daily chart for ETH/BTC shows that Ethereum (ETH) and other cryptocurrencies surged a few percent against Bitcoin (BTC) and all of a sudden everyone starts talking about altcoin season again. That is all fine and good and if it happens but as investors we need not to be in the hoping or wishing business. Looking at the daily chart for ETH/BTC, it is nearly impossible to fathom what makes most of these retail bulls so bullish. There is a strong trend line resistance that goes back to the beginning of the bear market in early 2018. The last time ETH/BTC made a double top at this trend line resistance, we saw the price fall massively. The exact same thing is happening right now but everyone is bullish which makes the bearish case more convincing.

A lot of bears got liquidated on the way up during the recent series of rallies. They might have been right about the long term outlook of the market but they were wrong about the short term outlook. Trading is all about timing and as we know now most retail bears entered short selling positions at the wrong time and got wiped out. Back then, the bulls were not so convinced the price could rise in this manner. It was when the price did print a few green bars tot eh upside that the bulls became more confident and later on, complacent. Now, this bearish setup is staring all of us in the face but very few people are going to take this opportunity. Why? Most of the retail bears already got liquidated and they are too scared to short Ethereum (ETH) at this point while most of the retail bulls have become too complacent and they are reluctant to sell hoping for higher prices.

The whales are luring in cryptocurrency traders with two psychological levels. On the BTC/USD front, it is the $10,000 target and on the ETH/USD front, it is the $300 target. Those are psychological levels that most retail bulls think they would be comfortable selling some of their holdings at. Now, the thing is the retail bulls do not have a game plan while the whales did have a game plan when they orchestrated all this. Most retail bulls were caught by surprise when the price started to rise this way. They never expected the price to go so fast, so soon. The fact that it did have made them thinking this could go on for a long time as “the bull market has just begun”.

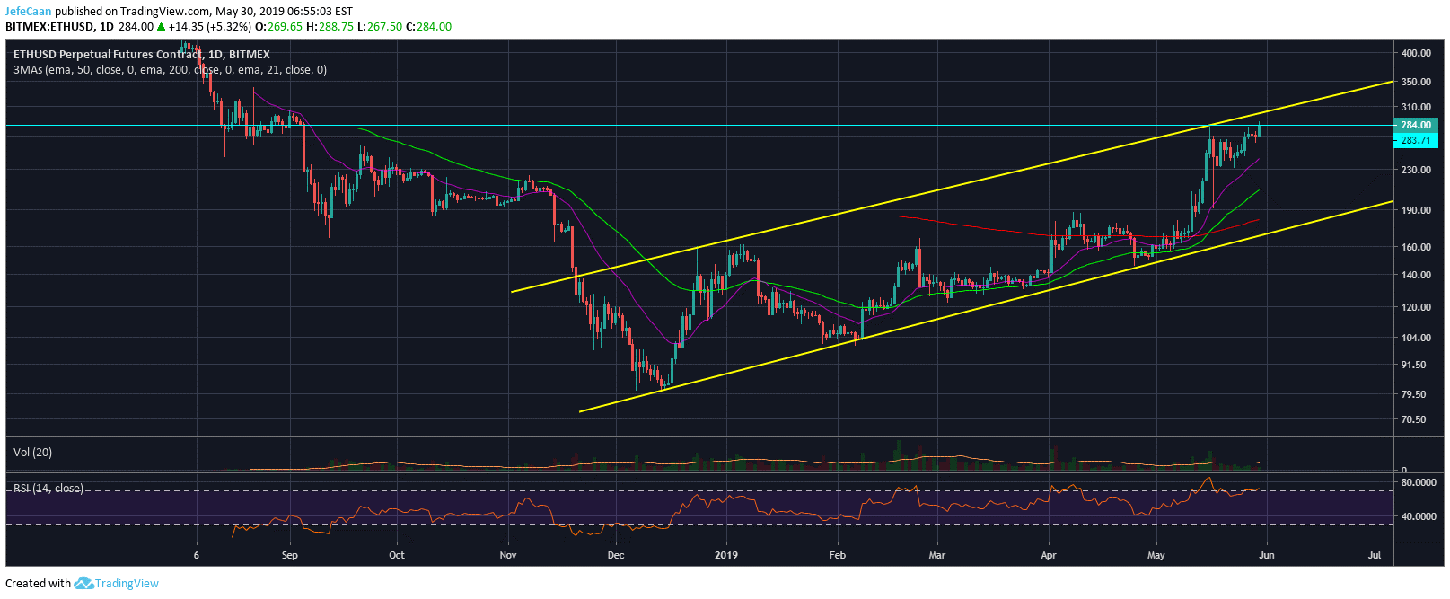

It is still quite possible for the price to rise to $300 but that would be too predictable and a lot of people would want to sell at those levels. Throughout the ongoing bear market, we have seen the price dump in a very systemic manner. It is never made to appear that the price is going down hard. A certain level of hope is induced in the market and the bulls are lured to buy the dip. So, the decline is a slow bleed and never a hard fall because that would spook the horse. The whales want to keep the retail bulls hooked up as they slowly dump on them. However, this time with the Bitfinex and Tether (USDT) controversy, the whales seem to be in a hurry and it might not be surprising to see the price crash hard below $200 in the weeks and months ahead.

Leave A Comment