Bitcoin

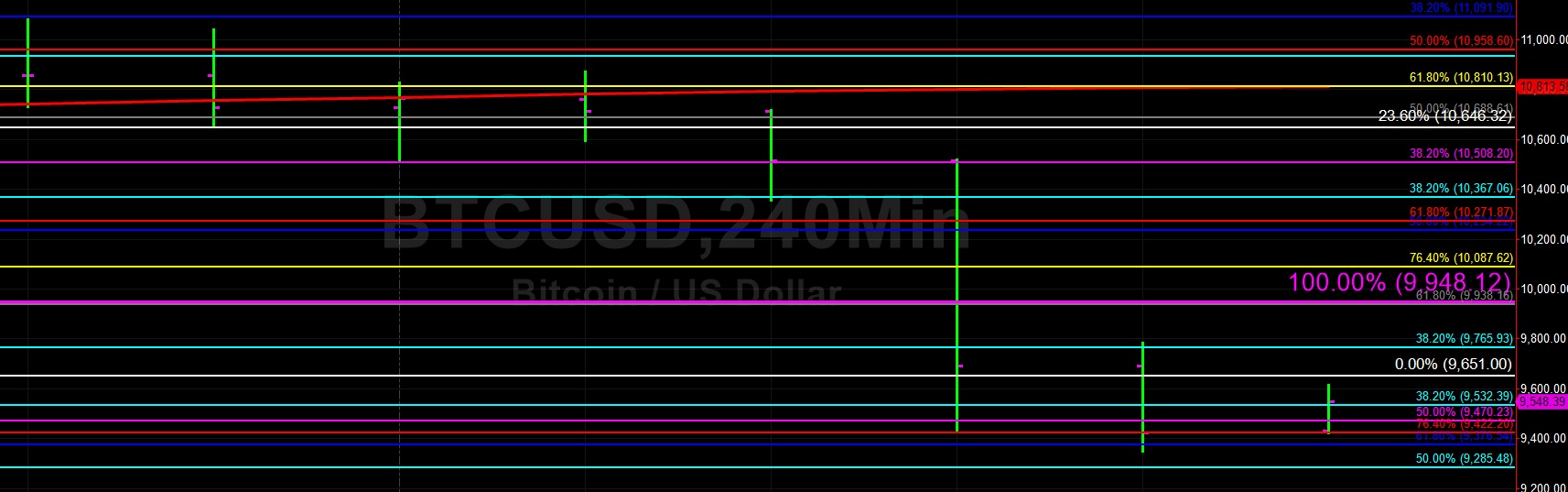

Bitcoin (BTC/USD) fell sharply early in the Asian session as the pair traded as low as the 9350.00 area after consistent selling started in earnest during yesterday’s Asian session when the pair was trading around the 11,080.01 area. This was just below the 38.2% retracement of the move from 6,600 to 13,868.44, and the pair’s weakest showing since around 20 June. The pair quickly moved below the 200-bar MA (4-hourly) as additional bearish sentiment intensified. A relatively small amount of buying activity materialised during yesterday’s European session around the 10,512.56 area, right around the 38.2% retracement of the 5,072.01 – 13,868.44 range.

Early in yesterday’s North American session, demand showed up around another important technical level, namely the 10,367.06 area that represents the 38.2% retracement of the move from 4,702.53 to 13,868.44. Selling pressure then strengthened during yesterday’s North American session and major Stops were elected below key levels. These areas included the 10,271, 10,087, 9,938, 9,765, and 9,532 levels. During a slight rebound early in the Asian session, traders pushed the pair higher and tested the 9,765.93 area, representing the 38.2% retracement of the move from 3,128.89 to 13,868.44. Below current market activity, traders cite technical Support around the 9,285.48 area with some Bids expected between the 8,920 – 9,010 levels.

Price activity is nearest the 200-bar MA (4-hourly) at 10,813.54 and the 50-bar MA (Hourly) at 10,362.91.

Technical Support is expected around 9,285.48/ 9,009.65/ 8,488.00 with Stops expected below.

Technical Resistance is expected around 10,087.62/ 10,646.32/ 11,510.44 with Stops expected above.

On 4-Hourly chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

Ethereum

Ethereum (ETH/USD) extended recent losses and weakened early in today’s Asian session as the pair moved to the 190.11 area after failing to eclipse the 236.43 area during yesterday’s Asian session, an area that represents the 61.8% retracement of the move from 157.28 to 364.49. Decent Stops were then triggered below the 217.55 area during yesterday’s North American session, representing the 61.8% retracement of the move from 302.20 to 80.60.

Larger Stops were then elected below the 209.75 area later in yesterday’s North American session, representing the 23.6% retracement of the 627.83 – 80.60 range. Some light Stops were triggered before ETH/USD moved to daily lows when traders were able to push the price below the 190.78 area, representing the 23.6% retracement of the 547.40 – 80.60 range. Chartists cite some Bids around the 183 and 165 areas.

Price activity is nearest the 50-bar MA (4-hourly) at 264.12 and the 50-bar MA (Hourly) at 221.35.

Technical Support is expected around 183.33/ 165.25/ 157.28 with Stops expected below.

Technical Resistance is expected around 217.55/ 236.43/ 257.22 with Stops expected above.

On 4-Hourly chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

Leave A Comment