The S&P 500 (SPX) has recently shown signs of strength amid fears of a massive crash. The mainstream media keeps on talking about the next recession and a lot of people are expecting the next crash to be that. While I do think we are likely to see further downside in the S&P 500 (SPX) in the near future, I do not expect it to happen while everyone is talking about it. As the chart shows, the index has now climbed above the 50 day EMA and this could mean that we might be headed towards a new all-time high. The RSI shows that there is plenty of room for such a move as the conditions remain well below overbought. So, if the index starts to rally on Monday, we will have confirmation that we can see similar upside in Bitcoin (BTC).

The correlation between BTC/USD and the S&P 500 (SPX) has become increasingly easier to see. In October of 2018 when the index started to decline, we saw BTC/USD prepare for a similar decline and it eventually ended up crashing following the lead of the stock market. Recently however, a lot of people seem to think that something worse happening in the stock market could benefit Bitcoin (BTC). I think it had more to do with the staged correlation with Gold rather than something bad happening in the stock market. The whales and big investors that ‘control’ the price of Bitcoin (BTC) do not invest in cryptocurrencies alone. It makes sense that they would take advantage of moves in the stock market too. So, if we see a sharp decline in the stock market, it makes sense that a lot of these whales and big investors would sell their Bitcoin (BTC) and other cryptocurrencies to buy the dip in the stock market.

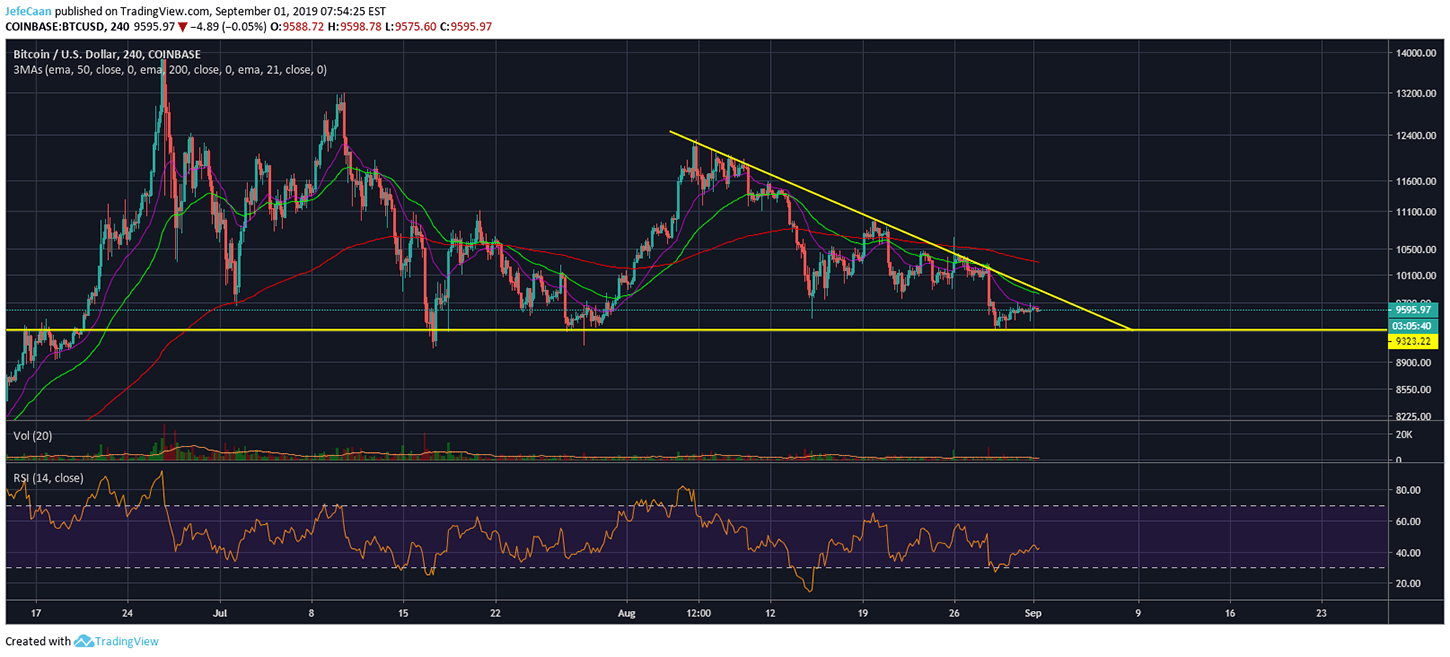

As the S&P 500 (SPX) has room to rally further, the whales have no reason to liquidate their BTC/USD positions. In addition to that, the market makers want to shake out the bears and trap in more bulls. In the past 48 hours, they have made the price action very confusing for both sides so both are likely to be taken advantage of. The 4H chart for BTC/USD shows that the descending triangle might be invalided and we might see a big move to the upside that will liquidate the bears and make the bulls more confident that a new yearly high is to come.

Bitcoin (BTC) despite its short term challenges remains as the top contender for a global currency that we will soon have. It could be Bitcoin (BTC) or anything else but we are headed towards globalization and money is one of the biggest impediments. Bitcoin (BTC) has solved this and it would not be surprising to see that soon we might have a one world currency and one world blockchain where the people one borderless Earth vote on issues together and do business with each other.

Source link