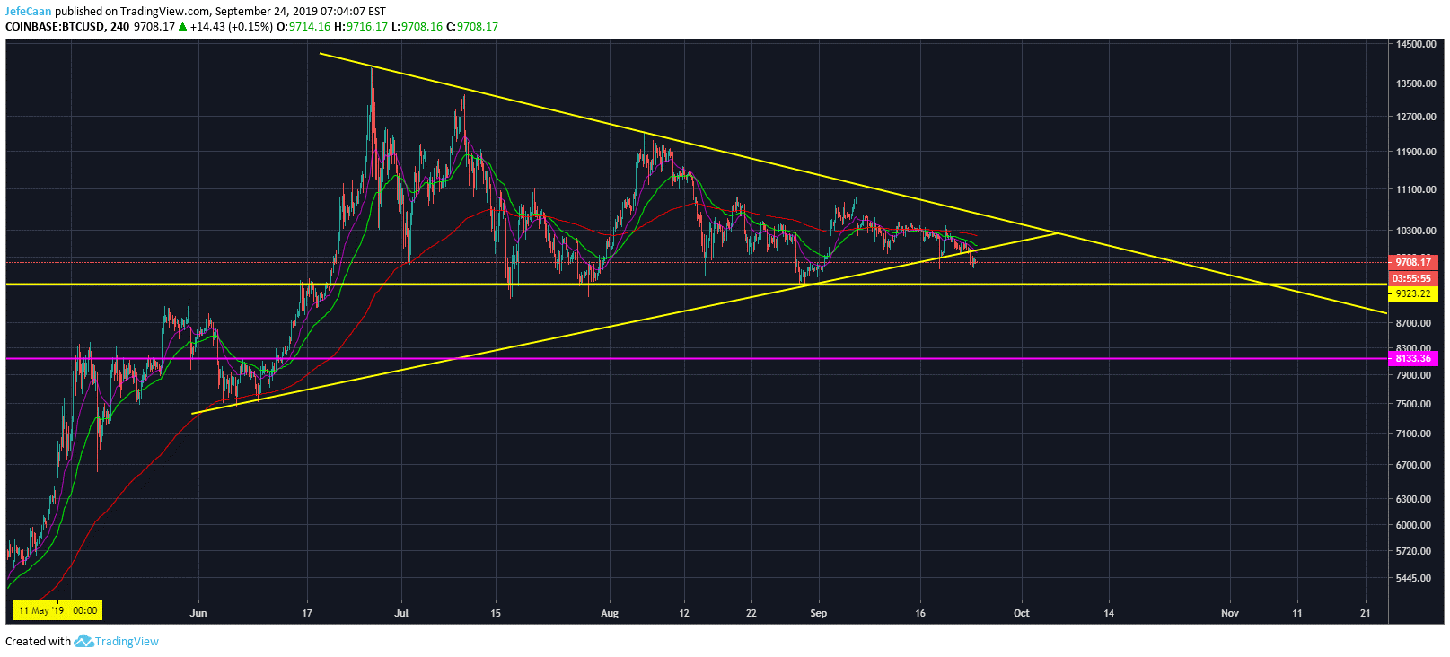

Bitcoin (BTC) is trading within a large pennant that bears a strong resemblance to a similar pennant from 2014. The conditions are very much the same as well. Back then BTC/USD crashed hard and then started to rally from there. When the price started to rally after the first downtrend, most traders falsely assumed that the bear market had ended. The pump after the previous downtrend made traders even more complacent and when breakout time came, the majority was very surprised when BTC/USD declined more than 73% in another brutal downtrend. It is interesting how everything is the same this time as well. The majority believes the bear market is over and the recent parabolic move since December, 2018 has made a lot of traders complacent to the point that they have no problem holding on to their Bitcoin (BTC) bags.

The market makers have got the retail traders where they want them. They are complacent, hopeful and optimistic. They also have a lot more tolerance so if the price declines 10% from here, they would be buying the dips. This is the perfect scenario from a market maker’s perspective which is why they are very close to pulling the plugs. We have noticed in the last few days that the momentum has shifted to the bearish side. No matter how hard the bulls try to buy the dips the price does the inevitable eventually. We have seen some very long wicks to the downside which would normally be a sign of bullish interest around those levels but in this market, in the past few days, we have seen the price break downwards despite such signs because the momentum has turned bearish.

We are likely to see more of such big wicks to the downside as big investors try to get rid of their bags before the next crash. The market makers have no incentive to spook retail bulls. They want to keep them comfortable buying the dips and that is what we have seen happen so far. However, if we look at the 4H chart for BTC/USD, we can see that the symmetrical triangle has now been broken and we are finally sure that the descending triangle is what matters. Now that the price is trading within this descending triangle, a lot of bears are beginning to get more interested in short selling Bitcoin (BTC).

The market makers want to trap longs but at the same time they don’t want shorts to stack up. So, there is a delicate balance that they have to find and before the bears can get any more smarter, I think we are very likely to see a sharp decline down to the 50 Week EMA. The price is likely to bounce back up above $8,133 and find some temporary support there before an attempt to test the broken descending triangle again. If it faces a strong rejection there that is when we will more than 70% decline begin that is going to inflict unprecedented pain on this market.

Leave A Comment