Ethereum (ETH) is primed for its deadliest fall in months as all key indicators point to extremely bearish outlook. The weekly chart for ETH/USD shows a strong bearish divergence on the RSI that confirms. The trend line resistance shown on the RSI has been rejected and the RSI is expected to fall further in the days and weeks ahead. Similarly, the price has faced a strong rejection near the Ichimoku cloud on the weekly chart and is now ready to fall towards the bottom of the ascending channel it is trading in. Interestingly, this ascending channel forms part of a large bear flag that could see the price fall lower than our previously stated target of $60 per coin by the end of the year. Recently, over $7 million worth of Ethereum (ETH) were hacked and transferred to an unknown wallet. At this point, Ethereum (ETH) is not short of catalysts that could push the price off a cliff.

The number of ICO scams has been on a steady rise with Bitconnect making its entry again in July, 2019. It is clear that the SEC is going to have to step in at some point before serious damage is done and when that happens, it is not going to be a good day for Ethereum (ETH). We have discussed in our previous analyses that for the bear market to be over, we have to see most of these useless coins get wiped off the market. So far that has not happened and investors still have quite an appetite for risk taking. We have also pointed to a maximum pain scenario. On that front, the bears have already experienced maximum pain as most of them were put out of their positions as Ethereum (ETH) kept on surging in a parabolic manner these past few weeks. However, the bulls are yet to see maximum pain and all the key indicators on larger time frames show us that it might happen soon.

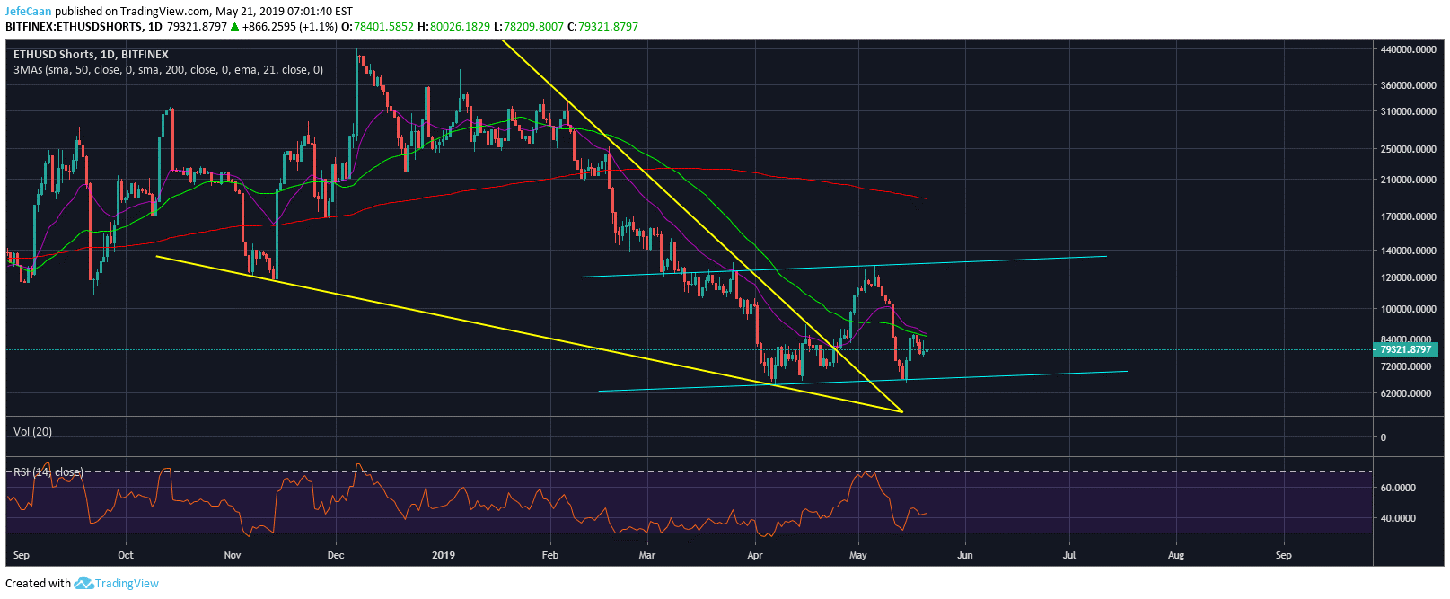

The daily chart for ETHUSDShorts shows that the bears have been very reluctant to push back after their recent experience. The number of margined shorts against ETH/USD is still having trouble breaking past the 50 day moving average. We could see ETHUSDShorts attempt to rally towards the top of the ascending channel towards the end of the month but it has become quite clear that retail bears have lost their appetite for short selling after the recent stop hunt.

Retail bulls on the other hand are more optimistic than ever as most of them assume that the bottom is in. The Fear and Greed Index is down to 68 today from 73 yesterday. This shows that the bulls are beginning to think if this rally can really continue from here without the price seeing a sharp retracement first. The whales are unlikely to allow most of these retail bulls to cash out their winnings. Just as we saw recently, the price of Ethereum (ETH) flash crashed from $243 to $191 in a matter of minutes. The same is likely to happen again when the whales realize that FOMO buying is beginning to lose steam. Most retail bulls would be left holding the bags as the whales dump on them again.

Leave A Comment