Bitcoin

Bitcoin (BTC/USD) extended its rebound higher early in today’s Asian session as the pair continued to reclaim lost ground following Thursday’s move that saw a sudden depreciation from 9090.00 to 7972.00. There have now been five consecutive 4-hourly bars with higher highs and higher lows, a bullish development that saw the pair test the 8580.00 level early in today’s session. BTC/USD has also managed to move back above the 50-bar MA (4-hourly), another bullish development.

Some Stops were elected above the 8531.00 figure late in yesterday’s North American session, representing the 50% retracement of the move from 9090.00 to 7972.00. Additional upside targets related to that range include 8662.92 and 8826.15. Another important level remains the 8707.00 area, representing the 23.6% retracement of the move from 7467.10 to 9090.00. Following the recent move higher, traders are also interested to see if the pair can establish a base around the 8488.00 level, representing a relative historical high.

Price activity is nearest the 50-bar MA (4-hourly) at 8420.19 and the 100-bar MA (Hourly) at 8591.98.

Technical Support is expected around 7850.10/ 7659.87/ 7343.17 with Stops expected below.

Technical Resistance is expected around 9090.00/ 9532.02/ 9948.12 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

Ethereum

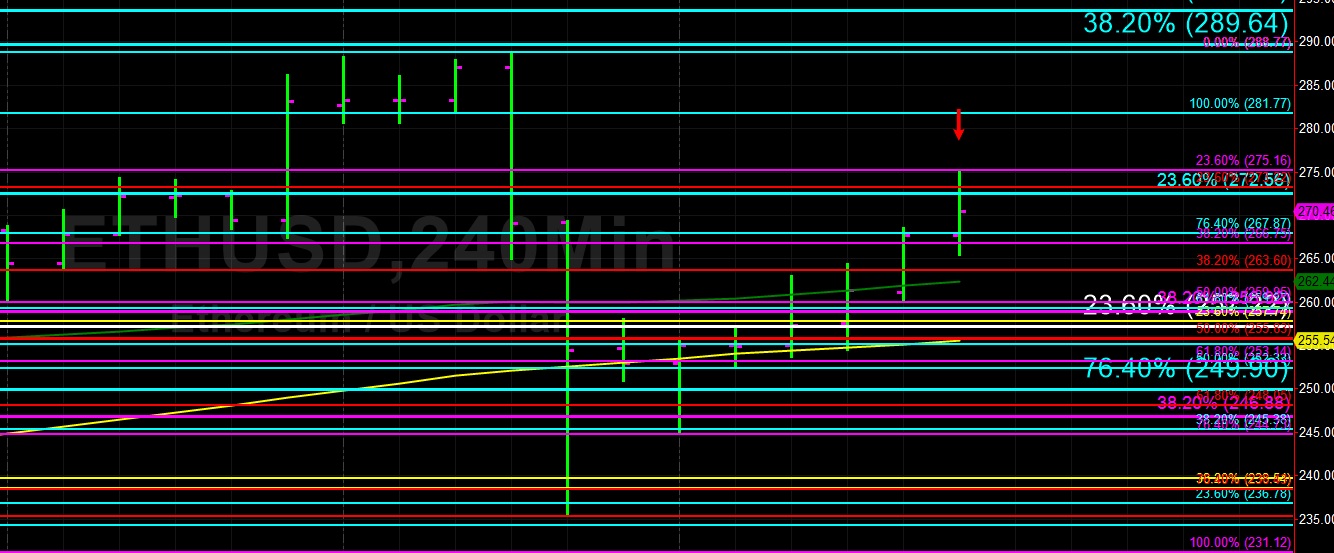

Ethereum (ETH/USD) marched higher early in today’s Asian session, adding to the pair’s recent gains following Thursday’s dramatic depreciation from the 288.77 level to the 235.44 area. After Stops were elected above the 50-bar MA (4-hourly) during yesterday’s European session, the pair encountered technical Resistance for several hours around the 263.60 area, representing the 38.2% retracement of the move from 222.88 to 288.77.

Early in today’s Asian session, ETH/USD tested the 275.16 area, an important level that represents the 23.6% retracement of the move from 231.12 to 288.77. After encountering technical Resistance there, the pair retreated lower as traders awaited an indication the market have the strength to elect Stops that are likely above that area. Traders are also paying very close attention to the 281.77 area, a recent relative high that gave way a couple of days ago during the pair’s move higher. If ETH/USD is able to derive additional buying interest, upside targets include 289.64/ 293.56/ 302.20.

Price activity is nearest the 50-bar MA (4-hourly) at 262.45 and the 100-bar MA (Hourly) at 268.30.

Technical Support is expected around 259.88/ 244.96/ 235.44 with Stops expected below.

Technical Resistance is expected around 281.77/ 289.64/ 298.24 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bearishly below SlowD while MACD is Bullishly above MACDAverage.

Source link